Editor's note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

The Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla —have defined this market cycle, dominating returns over the past several years. But after topping out as a group in late 2024, are they back in the driver’s seat, or is more turbulence ahead?

Recent volatility* tied to reports of DeepSeek’s artificial intelligence (AI) breakthrough sent shockwaves through the market, particularly weighing on Nvidia, the semiconductor giant and one of the Mag 7 leaders. Meanwhile, renewed political and tariff uncertainty around the new Trump administration and interest rate expectations could be shaping the market’s next big moves.

For traders looking to play the group in a single trade, the Direxion Daily Magnificent 7 Bull 2X Shares (Ticker: QQQU) and Direxion Daily Magnificent 7 Bear 1X Shares (Ticker: QQQD) seek daily investment results, before fees and expenses, of 200%, or 100% of the inverse (or opposite), respectively, of the performance of the Indxx Magnificent 7 Index.* The index is provided by Indxx and is designed to track the performance of the leading seven Nasdaq-listed companies, as identified by Indxx.

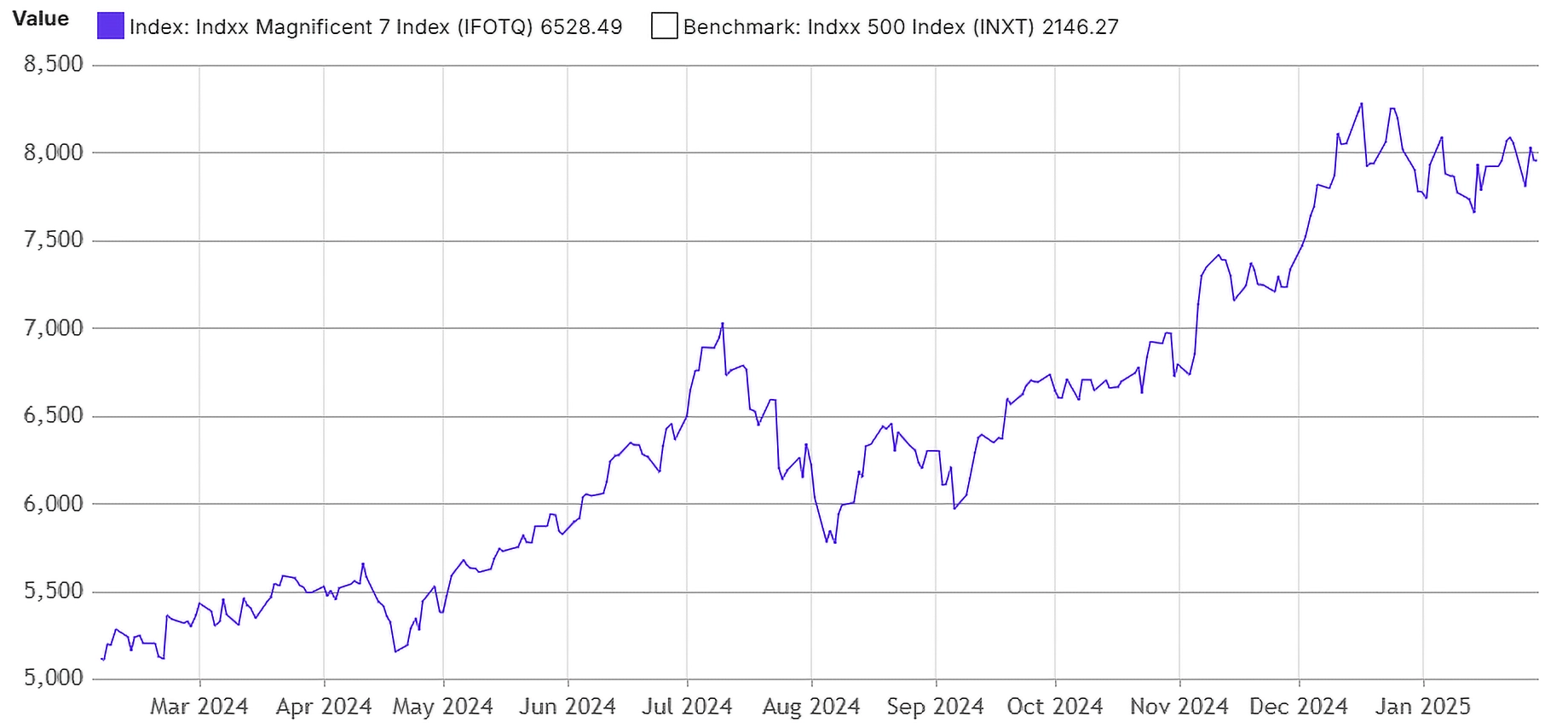

Below is a daily chart of the Indxx Magnificent 7 Index as of January 29, 2025.

Source: Indxx, January 29, 2025.

The performance data quoted represents past performance. Past performance does not guarantee future results.

Recent Earnings Recap and Upcoming Reports

Most Magnificent 7 companies have reported their earnings, providing insights into their businesses and profits:

- Microsoft Corporation (MSFT): Reported on January 29, 2025, with earnings per share (EPS)* of $3.13, a 6.6% year-over-year increase, and revenue of $68.82 billion, up 10.9%.

- Tesla, Inc. (TSLA): Reported on January 29, 2025, with revenue of $27.07 billion, a 7.5% increase, but a significant drop in EPS to $0.76, down 66.7% year-over-year.

- Meta Platforms, Inc. (META): Reported on January 29, 2025, with EPS of $6.73, a 30.7% increase, and revenue of $46.96 billion, up 17.2%.

- Apple, Inc. (AAPL): Reported on January 30, 2025, with revenue of $124.1 billion, a 4.0% year-over-year increase, and EPS of $2.35, up 8.4%.

- Alphabet Inc. (GOOGL): Reported its fourth-quarter 2024 earnings on February 4, 2025. The company announced revenue of $96.5 billion, a 12% year-over-year increase, and earnings per share (EPS) of $2.15, up 31%. (as of 2/4/25).

- Amazon.com Inc. (AMZN): Reported its fourth-quarter 2024 earnings on February 6, 2025. The company announced net sales of $187.8 billion, a 10% year-over-year increase, and earnings per share (EPS) of $1.86, up from $1.00 in the same quarter the previous year.

Looking ahead, Nvidia (NVDA) is scheduled to report on February 20, 2025.

The Bull Case: A Safety Trade in Mega-Caps?

Despite the turbulence, some traders see recent price action as an opportunity. While small-cap stocks have been struggling, the Magnificent 7 have continued to attract capital. One potential reason? A “safety trade” back into mega-caps.

Even after recent pullbacks, these companies remain dominant in their industries and generate enormous cash flows. Nvidia continues to lead in AI processing, Apple’s ecosystem remains sticky as demonstrated by its recent earnings report, and Microsoft’s cloud business keeps growing. With volatility rising, some investors may prefer to stick with what’s been working.

Further, the new Trump administration could bring policy shifts that favor these companies. If regulatory concerns ease and corporate tax rates remain low, these names could continue their dominance.

The Bear Case: Overvaluation, Rotation, and Market Risk

On the other side, there’s a growing argument that the Magnificent 7 have run too far, too fast.

- Expensive Valuations: These companies have already seen huge gains, and if growth slows, high valuations could come under pressure.

- Competition Heating Up: DeepSeek’s potential challenge to Nvidia and other AI leaders is just one example—tech is a fast-moving space, and today’s leaders could face disruption.

- A Potential Rotation to Small Caps: If investors start looking beyond large-cap tech, other sectors could outperform, pulling capital away from these names.

- Economic Uncertainty: If the economy weakens or interest rates stay higher for longer, even dominant tech companies could struggle.

Tools to Trade the Magnificent 7

Whether you’re bullish or bearish on this elite group, Direxion’s QQQU and QQQD offer a way to trade these stocks with leveraged exposure from both the bull and bear sides. With volatility picking up, traders have more tools to seize short-term opportunities in the market’s most-watched stocks.

*Definitions and Index Descriptions

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

The Indxx Magnificent 7 Index (IFOTQ) is provided by Indxx and is designed to track the performance of seven of the leading NASDAQ listed companies, as identified by Indxx. The Magnificent 7 is comprised of the following companies: Apple, Alphabet, Microsoft, Amazon, Nvidia, Tesla, and Meta. One cannot invest directly in an index.

Direxion Shares Risks – An investment in a Fund involves risk, including the possible loss of principal. A Fund is non-diversified and includes risks associated with the Fund’s concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause prices to fluctuate over time.

Leverage Risk – The Bull Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. A total loss may occur in a single day. Leverage will also have the effect of magnifying any differences in the Fund’s correlation or inverse correlation with the Index and may increase the volatility of the Fund.

Daily Index Correlation Risk – A number of factors may affect the Bull Fund’s ability to achieve a high degree of correlation with the Index and therefore achieve its daily leveraged investment objective. The Bull Fund’s exposure to the Index is impacted by the Index’s movement. Because of this, it is unlikely that the Bull Fund will be perfectly exposed to the Index at the end of each day. The possibility of the Bull Fund being materially over- or under-exposed to the Index increases on days when the Index is volatile near the close of the trading day.

Daily Inverse Index Correlation Risk – A number of factors may affect the Bear Fund’s ability to achieve a high degree of inverse correlation with the Index and therefore achieve its daily inverse investment objective. The Bear Fund’s exposure to the Index is impacted by the Index’s movement. Because of this, it is unlikely that the Bear Fund will be perfectly exposed to the Index at the end of each day. The possibility of the Bear Fund being materially over- or under-exposed to the Index increases on days when the Index is volatile near the close of the trading day.

Information Technology Sector Risk — The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation, and competition, both domestically and internationally, including competition from competitors with lower production costs.

Additional risks of each Fund include Effects of Compounding and Market Volatility Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs Risk), Cash Transaction Risk, Passive Investment and Index Performance Risk and for the Direxion Daily Magnificent 7 Bear 1X Shares, Shorting or Inverse Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of a Fund.