MAG 7 (And More) Earnings: Will Last Year’s Hot Stocks Soar or Flop?

Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

Investing in the funds involves a high degree of risk. Unlike traditional ETFs, or even other leveraged and/or inverse ETFs, these leveraged and/or inverse single-stock ETFs track the price of a single stock rather than an index, eliminating the benefits of diversification. Leveraged and inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying stock’s performance over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments. The Funds will lose money if the underlying stock’s performance is flat, and it is possible that the Bull Fund will lose money even if the underlying stock’s performance increases, and the Bear Fund will lose money even if the underlying stock’s performance decreases, over a period longer than a single day. An investor could lose the full principal value of his or her investment in a single day. Investing in the Funds is not equivalent to investing directly in AAPL, AMZN, AVGO, BRK.B, GOOGL, META, MSFT, MU, NFLX, NVDA, PLTR, TSLA, and TSM.

2024 Q4 earnings season is upon us, and brings heightened anticipation for high-growth tech names, including the so-called “Magnificent 7” stocks (AAPL, AMZN, AVGO, BRKB, GOOGL, META, MSFT), along with notable players like PLTR, MU, NFLX, NVDA, TSLA, and TSM. This elite group could set the tone for broader market performance.

Upside Potential

Mega-cap tech leaders have proven their ability to weather macro challenges, often emerging stronger. With artificial intelligence, cloud computing, and advanced chip manufacturing as tailwinds, stocks like NVDA, TSLA, and META could deliver impressive results. Meanwhile, PLTR and MU may highlight AI-driven expansion and cost efficiencies, appealing to growth-focused investors.

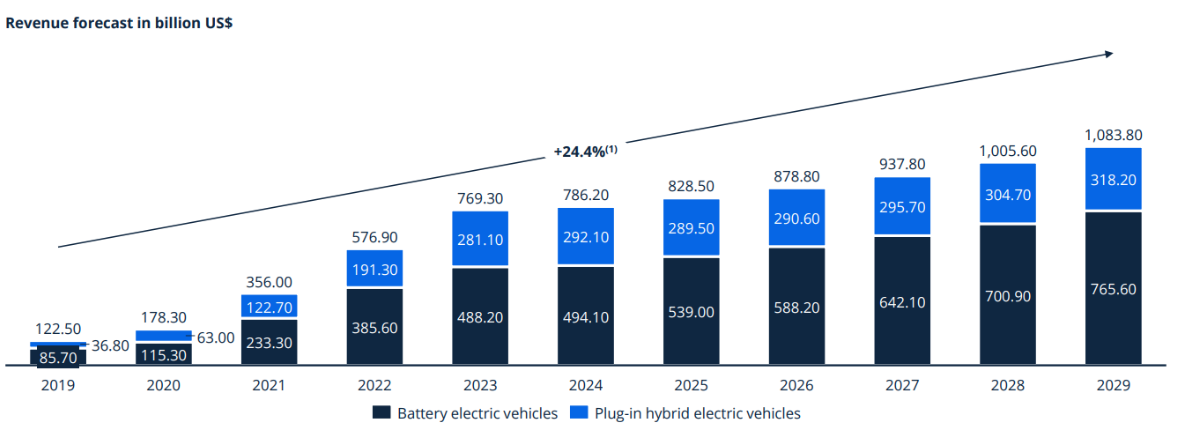

Apple and Amazon are expected to report strong consumer demand despite inflationary pressures, while TSM might benefit from recovering chip demand globally. Traders will be closely watching NVDA and TSLA for updates on AI and EV adoption, two sectors poised for exponential growth. It is estimated that the revenue in the Electric Vehicles market will increase at a compound annual growth rate of 26.1% from 2019 to 2029 (Statista).

Electric Vehicle Market Revenue Estimates from 2019 to 2029

Source: Statista, 2025

Downside Risks

Still, the stakes are high. Elevated valuations leave these stocks vulnerable to sharp declines on any earnings misses. Microsoft and Google could face scrutiny over cloud growth rates, while Apple and Amazon may report slower-than-expected consumer spending due to macroeconomic constraints.

Micron (Ticker: MU) and Taiwan Semiconductor's (Ticker: TSM) outlooks will be pivotal, given ongoing supply chain concerns and geopolitical risks in semiconductor manufacturing. Meta, despite its dominance in social media, may see headwinds from tighter ad budgets.

For short-term traders, this group offers substantial opportunities. Watch for after-hours price moves and key technical levels following announcements. Pre-earnings straddles or post-earnings momentum plays could prove risky as volatility* surges. Whether these stocks deliver beats or disappointments, their impact on market sentiment will be profound.

Below is a list of key earnings dates, including, but not exclusive to the Magnificent Seven.

Earnings dates are subject to change without notice.

Q4 2024 Earnings Season - % of Each Index Reporting by Week

Source: Bloomberg Data Management Services. Figures represent percent of companies in each index expected to release earnings reports by week. Green shading identifies the week with the highest percentages. Index descriptions are provided at the end of the page.

Single Stock ETFs

- Direxion Daily AAPL Bull 2X (AAPU) and Bear 1X (AAPD) Shares

- Direxion Daily AMZN Bull 2X (AMZU) and Bear 1X (AMZD) Shares

- Direxion Daily AVGO Bull 2X (AVL) and Bear 1X (AVS) Shares

- Direxion Daily BRKB Bull 2X (BRKU) and Bear 1X (BRKD) Shares

- Direxion Daily GOOGL Bull 2X (GGLL) and Bear 1X (GGLS) Shares

- Direxion Daily META Bull 2X (METU) and Bear 1X (METD) Shares

- Direxion Daily MSFT Bull 2X (MSFU) and Bear 1X (MSFD) Shares

- Direxion Daily MU Bull 2X (MUU) and Bear 1X (MUD) Shares

- Direxion Daily NFLX Bull 2X (NFXL) and Bear 1X (NFXS) Shares

- Direxion Daily NVDA Bull 2X (NVDU) and Bear 1X (NVDD) Shares

- Direxion Daily PLTR Bull 2X (PLTU) and Bear 1X (PLTD) Shares

- Direxion Daily TSLA Bull 2X (TSLL) and Bear 1X (TSLS) Shares

- Direxion Daily TSM Bull 2X (TSMX) and Bear 1X (TSMZ) Shares

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| MSFT UW | MICROSOFT CORP | MSFU/MSFD | 1/29/2025 |

| TSLA UW | TESLA INC | TSLL/TSLS | 1/29/2025 |

| AAPL UW | APPLE INC | AAPU/AAPD | 1/30/2025 |

| GOOGL UW | ALPHABET INC-CL A | GGLL/GGLS | 1/30/2025 |

| AMZN UW | AMAZON.COM INC | AMZU/AMZD | 1/31/2025 |

| NVDA UW | NVIDIA CORP | NVDU/NVDD | 2/26/2025 |

| META UW | META PLATFORMS INC-CLASS A | METU/METD | 1/29/2025 |

| NFLX UW | NETFLIX INC | NFXL/NFXS | 1/21/2025 |

| TSM UN | TAIWAN SEMICONDUCTOR-SP ADR | TSMX/TSMZ | 1/16/2025 |

| BRK.B UW | BERKSHIRE HATHAWAY INC-CLASS B | BRKU/BRKD | 2/24/2025 |

| PLTR UW | PALANTIR TECHNOLOGIES INC | PLTU/PLTD | 2/3/2025 |

*Definitions and Index Descriptions

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

The Indxx Magnificent 7 Index is provided by Indxx and is designed to track the performance of the seven largest NASDAQ listed companies.

Direxion Shares ETF Risks – An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry, sector or company, which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of respective underlying security for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry, sector or company, please read the prospectus.