ETF market prices are the prices at which investors buy or sell shares of an ETF in the secondary market. While ETFs are designed to trade in line with their intraday values, during times of significant market volatility an ETF’s market price may vary more widely from its intraday value.

Pay Attention to the NAV

The closing NAV is the net asset value measured by the value of underlying holdings of the ETF published directly by the issuer. The closing price refers to the official price set by the exchange on which the ETF trades, as a result of trades during the closing auction. Although the closing price is often close to the NAV, it may be different. In highly volatile markets, this difference may be exaggerated.

ETF market prices are the prices at which investors buy or sell shares of an ETF in the secondary market. While ETFs are designed to trade in line with their intraday values, during times of significant market volatility an ETF’s market price may vary more widely from its intraday value.

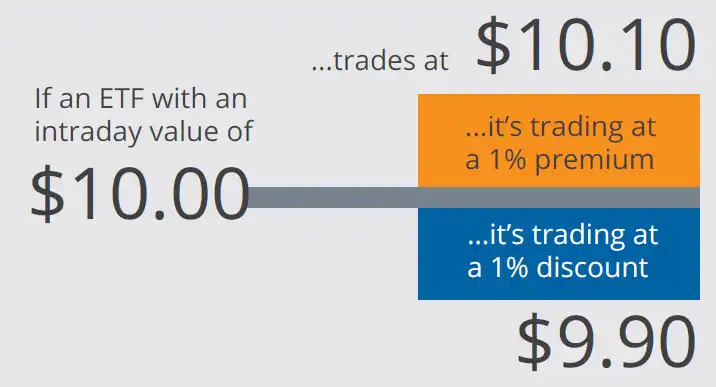

Trading at a Discount or Premium

ETFs generally trade close to their approximate intraday values, but they can trade at a premium or discount due to the forces of supply and demand. Those market forces determine how closely an ETF will trade to its intraday value.

Premiums and discounts are expressed as a percentage of an ETF’s intraday value. For example, if an ETF’s intraday value is $10 and it’s selling for $10.10, it’s trading at a 1% premium to its intraday value. Similarly, if the ETF is selling for $9.90, it’s trading at a 1% discount to its intraday value.

As supply and demand pushes an ETF away from fair value, market makers arbitrage the deviations by selling the ETF at a premium, and buying shares at a discount, driving the price of the ETF back in line with the underlying index.

The best way to determine whether or not the ETF is tracking its index is to compare the NAV from the previous trading day, to the NAV for the following trading day.

- Intraday Pricing: The NYSE calculates an intra-day indicative NAV (INAV) every 15 seconds throughout the trading day. For domestic products, this is an excellent way to determine where the market should be, and whether or not the ETF is trading at a premium or discount intraday.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Investing in a Direxion Shares ETF may be more volatile than investing in broadly diversified funds. The use of leverage by an ETF increases the risk to the ETF. The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment. The Direxion Shares ETFs are not designed to track their respective underlying indices over a period of time longer than one day.

Direxion Shares Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non- diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. The ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. For other risks including leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector, please read the prospectus.