June Unemployment, The Magnificent 7, and Microsoft Outages

- Foot Off the Gas – Bitcoin ended June 2024 at a share price of $62,678.29, a $4,813.12 drop from the May 31, 2024 price of $67,491.41 (source: Yahoo Finance).

- Still Superstars – The Magnificent 7 (Apple, Amazon, Alphabet, Meta, Microsoft, NVIDIA, and Tesla) reported a collective 31% increase in stock price in the first half of 2024. These returns are four times the 7.4% return of the remaining 493 stocks listed on the S&P 500 (source: Y Charts).

- Man Down – Microsoft is in the hot seat after 8.5 million of its devices were affected by a CrowdStrike outage after a software update. The outage grounded flights, halted healthcare services, and impacted banking (source: Reuters).

- Up, Up, and Away – The June 2024 unemployment rate increased 0.1% to 4.1%. The District of Columbia had the highest unemployment rate in the nation at 5.4%, followed by California and Nevada at 5.2%. Connecticut had the only unemployment rate decrease in June 2024, dropping 0.4% to 3.9% (source: U.S. Bureau of Labor Statistics).

- Bain’s Big Deal – Bain Capital, a private equity firm, reached an agreement to acquire Envestnet, a U.S. financial software vendor used by 17 of the 20 largest U.S. banks, for $4.5 billion (source: Yahoo Finance).

- Netflix News – Netflix released its earnings call for the second quarter ended June 30, 2024, citing $9.56 billion in revenue, a 16.8% year-over-year increase. Netflix also added 8 million paying subscribers in Q2 2024 (source: Netflix).

- Again? – The food index rose 0.2% in June 2024, following a 0.1% increase in May 2024. The index for butter and margarine increased 2.4%, the dairy and related products index jumped 0.6%, and the meats, poultry, fish, and eggs index spiked 0.2%. These increases were partly offset by a 0.5% drop in the fruits and vegetables index and a 0.1% decline in the cereal and bakery products index (source: U.S. Bureau of Labor Statistics).

- Need a Job? – North Carolina accounted for the largest nonfarm payroll employment increase in June 2024 with 23,100 jobs filled. Massachusetts and Virginia were close behind, with 19,000 and 15,000, respectively (source: U.S. Bureau of Labor Statistics).

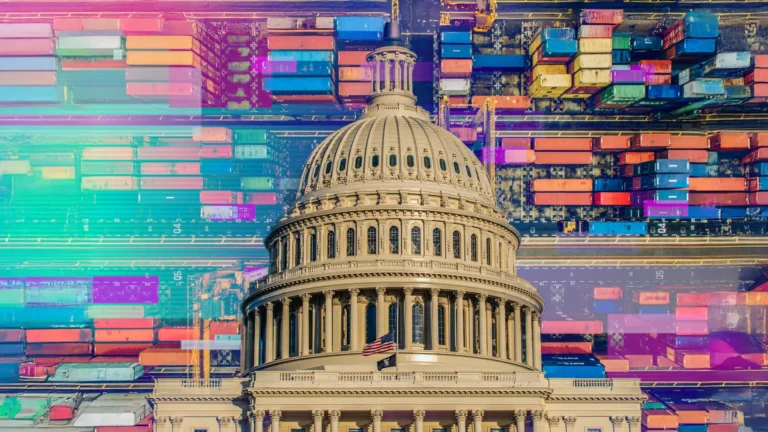

- Next Up – President Joe Biden dropped out of the 2024 presidential race on Sunday, July 21, endorsing current Vice President Kamala Harris (source: The New York Times).

- Fresh Talent – 16-year-olds Hezly Rivera (gymnast) and Quincy Wilson (track and field) have broken records as the youngest athletes headed to the Paris Olympics in their sports (source: NBC Connecticut).

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation regarding any specific product or security. Past performance is not indicative of future results. You cannot invest directly in an index. All references to tax or legal matters are provided for informational purposes only. You should consult your legal or tax professional regarding your specific situation. All investing is subject to risk, including possible loss of principal.

For current fund holdings, please click on the related links included above.