Whistleblowers, Bad Books, and Civil Rights Fights

- Downward Dive – The June 2024 Consumer Price Index reported a 0.1% decline, bringing the 12-month unadjusted average to 3.0%. The gasoline index dropped 3.8% in June 2024, following a 3.6% decline in May 2024 (source: U.S. Bureau of Labor Statistics).

- Restrictive Rights? – OpenAI whistleblowers filed a complaint with the U.S. Securities and Exchange Commission over the company’s restrictive non-disclosure agreements. The complaint alleges that OpenAI required employees to sign an agreement to waive their federal rights to whistleblower compensation (source: Reuters).

- Bad Books – The U.S. Department of Justice and Federal Bureau of Investigation are probing Arbor Realty Trust, a national direct lender, after short sellers published reports alleging the company had a distressed loan book. This resulted in an immediate 19% drop in share price (source: Reuters).

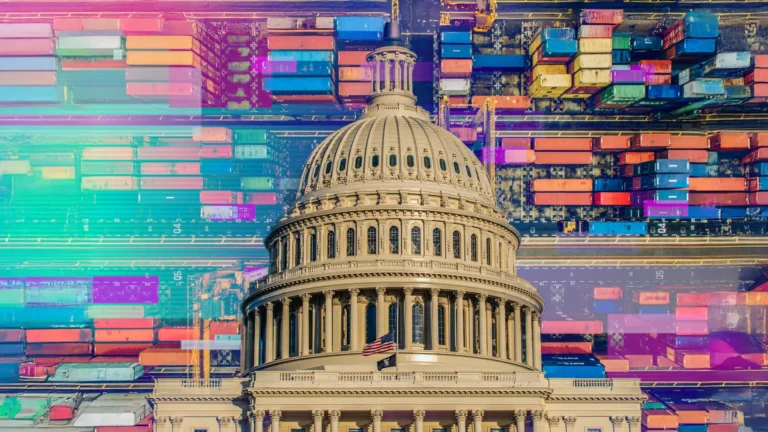

- Outside Expenditures – Expenditures by foreign direct investors to expand U.S. businesses totaled $148.8 billion in 2023. This is a $57.4 billion decline from 2022’s expenditures of $206.2 billion (source: U.S. Bureau of Economic Analysis).

- Data Breach – AT&T disclosed to the Securities and Exchange Commission that an unknown hacker compromised its network, stealing the calls and texts for more than 100 million wireless customers over a five-month period between 2022 and 2023 (source: Bloomberg).

- Flying High – Delta Air Lines released financials for the quarter ended June 30, 2024, announcing a 50% increase to the quarterly dividend and a 5.4% year-over-year increase in revenue. The company also reported pre-tax income of $2 billion despite fuel prices being 25% higher (source: Delta Air Lines).

- Sinking Staff – Wells Fargo & Company, a financial services company, reported a 3% decline in total revenue for the quarter ending June 30, 2024, partly influenced by a 25% drop in auto revenue. Due to the drop in revenue, Wells Fargo & Company also reduced its headcount in home lending by 45% (source: Wells Fargo & Company).

- Civil Rights Fight – Citigroup requested the dismissal of a pending racial discrimination lawsuit that claims the violation of federal civil rights by waiting ATM fees for customers of minority-owned banks. This lawsuit originates from two individuals who do not bank with Citigroup and were charged fees when using the ATM (source: Reuters).

- Raising a Racket – Carlos Alcaraz won Wimbledon, a world tennis tournament, in the finals against Novak Djokovic. Pete Sampras was the last American to win at Wimbledon in 2000 (source: AP News).

- Movie Madness – Pixar started July 2024 off strong, with Inside Out 2 becoming the company’s highest grossing movie on a global scale and the Despicable Me/Minions franchise reaching $5 billion globally (source: Deadline).

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation regarding any specific product or security. Past performance is not indicative of future results. You cannot invest directly in an index. All references to tax or legal matters are provided for informational purposes only. You should consult your legal or tax professional regarding your specific situation. All investing is subject to risk, including possible loss of principal.

For current fund holdings, please click on the related links included above.