Editor’s note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

One of the most anticipated earnings seasons in years is underway. So far, many companies have surpassed analysts’ earnings estimates to start the first-quarter reporting season. According to Credit Suisse, operating-profit margins were higher than expected. But markets aren’t rejoicing yet. There’s a long way to go.

Overall, the results of Q1 2023 earnings season will depend on a variety of factors, including macroeconomic trends, company-specific performance, and trading dynamics. Traders will be closely monitoring these factors to gain insights into the market and identify potential short-term opportunities.

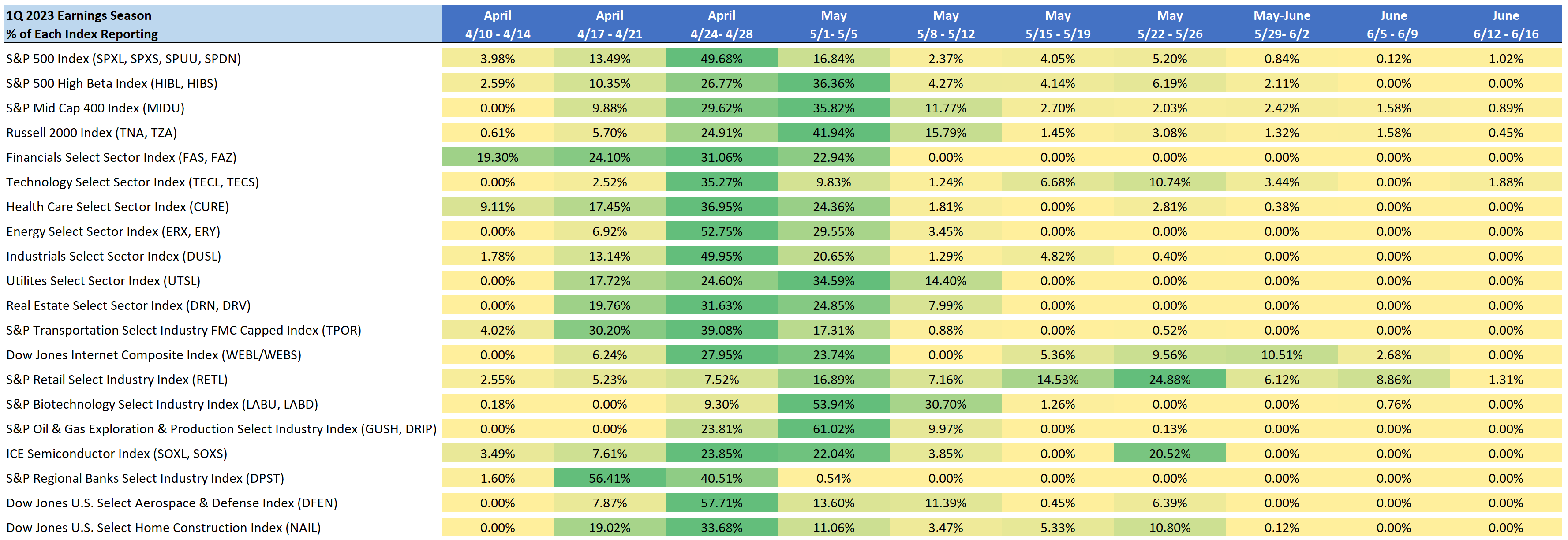

Here’s a list of announcement dates with related Leveraged & Inverse ETFs, week-by-week for 2023’s Q1 earnings season.

Q1 2023 Earnings Season - % of Each Index Reporting by Week

Source: Bloomberg Data Management Services. Figures represent percent of companies in each index expected to release earnings reports by week. Green shading identifies the week with the highest percentages. Index descriptions are provided at the end of the page. One cannot directly invest in an index.

S&P 500 Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| AAPL UW | Apple Inc | 7.10% | 4/28/2023 |

| MSFT UW | Microsoft Corp | 6.20% | 4/26/2023 |

| AMZN UW | Amazon.com Inc | 2.68% | 4/28/2023 |

| NVDA UW | NVIDIA Corp | 1.98% | 5/24/2023 |

| GOOGL UW | Alphabet Inc | 1.79% | 4/26/2023 |

| BRK/B UN | Berkshire Hathaway Inc | 1.62% | 5/1/2023 |

| TSLA UW | Tesla Inc | 1.58% | 4/20/2023 |

| GOOG UW | Alphabet Inc | 1.56% | 4/26/2023 |

| META UW | Meta Platforms Inc | 1.37% | 4/27/2023 |

| XOM UN | Exxon Mobil Corp | 1.32% | 4/28/2023 |

S&P 500 High Beta Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| NVDA UW | NVIDIA Corp | 1.96% | 5/24/2023 |

| AMD UW | Advanced Micro Devices Inc | 1.67% | 5/3/2023 |

| MPWR UW | Monolithic Power Systems Inc | 1.56% | 5/2/2023 |

| META UW | Meta Platforms Inc | 1.43% | 4/27/2023 |

| CZR UW | Caesars Entertainment Inc | 1.39% | 5/3/2023 |

| ON UW | ON Semiconductor Corp | 1.39% | 5/2/2023 |

| LRCX UW | Lam Research Corp | 1.31% | 4/19/2023 |

| AMAT UW | Applied Materials Inc | 1.29% | 5/17/2023 |

| INTU UW | Intuit Inc | 1.27% | 5/24/2023 |

| CCL UN | Carnival Corp | 1.27% | 6/23/2023 |

Financials Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| BRK/B UN | Berkshire Hathaway Inc | 12.54% | 5/1/2023 |

| JPM UN | JPMorgan Chase & Co | 8.60% | 4/14/2023 |

| V UN | Visa Inc | 8.26% | 4/26/2023 |

| MA UN | Mastercard Inc | 6.95% | 4/28/2023 |

| BAC UN | Bank of America Corp | 4.50% | 4/18/2023 |

| WFC UN | Wells Fargo & Co | 3.24% | 4/14/2023 |

| SPGI UN | S&P Global Inc | 2.58% | 5/3/2023 |

| MS UN | Morgan Stanley | 2.57% | 4/19/2023 |

| GS UN | Goldman Sachs Group Inc/The | 2.49% | 4/18/2023 |

| BLK UN | BlackRock Inc | 2.26% | 4/13/2023 |

Health Care Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| UNH UN | UnitedHealth Group Inc | 9.12% | 4/14/2023 |

| JNJ UN | Johnson & Johnson | 8.29% | 4/18/2023 |

| LLY UN | Eli Lilly & Co | 5.57% | 4/27/2023 |

| MRK UN | Merck & Co Inc | 5.54% | 4/27/2023 |

| PFE UN | Pfizer Inc | 4.69% | 5/2/2023 |

| TMO UN | Thermo Fisher Scientific Inc | 4.60% | 4/28/2023 |

| ABT UN | Abbott Laboratories | 3.60% | 4/19/2023 |

| DHR UN | Danaher Corp | 3.39% | 4/25/2023 |

| BMY UN | Bristol-Myers Squibb Co | 3.03% | 4/27/2023 |

| AMGN UW | Amgen Inc | 2.65% | 4/27/2023 |

Industrials Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| RTX UN | Raytheon Technologies Corp | 4.85% | 4/26/2023 |

| UPS UN | United Parcel Service Inc | 4.74% | 4/25/2023 |

| HON UW | Honeywell International Inc | 4.29% | 4/28/2023 |

| UNP UN | Union Pacific Corp | 4.13% | 4/20/2023 |

| BA UN | Boeing Co/The | 4.07% | 4/27/2023 |

| CAT UN | Caterpillar Inc | 3.98% | 4/28/2023 |

| DE UN | Deere & Co | 3.73% | 5/19/2023 |

| LMT UN | Lockheed Martin Corp | 3.64% | 4/19/2023 |

| GE UN | General Electric Co | 3.50% | 4/25/2023 |

| ETN UN | Eaton Corp PLC | 2.29% | 5/3/2023 |

Real Estate Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| PLD UN | Prologis Inc | 13.15% | 4/18/2023 |

| EQIX UW | Equinix Inc | 7.58% | 4/27/2023 |

| CCI UN | Crown Castle Inc | 6.64% | 4/20/2023 |

| PSA UN | Public Storage | 5.43% | 5/3/2023 |

| O UN | Realty Income Corp | 4.55% | 5/4/2023 |

| SPG UN | Simon Property Group Inc | 4.12% | 5/9/2023 |

| WELL UN | Welltower Inc | 3.87% | 5/10/2023 |

| VICI UN | VICI Properties Inc | 3.72% | 5/1/2023 |

| SBAC UW | SBA Communications Corp | 3.22% | 4/25/2023 |

| DLR UN | Digital Realty Trust Inc | 3.16% | 4/28/2023 |

Dow Jones Internet Composite Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| META UW | Meta Platforms Inc | 7.57% | 4/27/2023 |

| GOOGL UW | Alphabet Inc | 5.52% | 4/26/2023 |

| CSCO UW | Cisco Systems Inc | 5.38% | 5/17/2023 |

| CRM UN | Salesforce Inc | 5.30% | 5/31/2023 |

| GOOG UW | Alphabet Inc | 4.84% | 4/26/2023 |

| NFLX UW | Netflix Inc | 4.77% | 4/18/2023 |

| PYPL UW | PayPal Holdings Inc | 3.55% | 4/27/2023 |

| WDAY UW | Workday Inc | 2.84% | 5/26/2023 |

| ANET UN | Arista Networks Inc | 2.81% | 5/2/2023 |

| SNOW UN | Snowflake Inc | 2.74% | 5/25/2023 |

S&P Biotechnology Select Industry Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| VKTX UR | Viking Therapeutics Inc | 1.32% | 4/27/2023 |

| SGEN UW | Seagen Inc | 1.16% | 4/28/2023 |

| EXEL UW | Exelixis Inc | 1.12% | 5/10/2023 |

| CPRX UR | Catalyst Pharmaceuticals Inc | 1.12% | 5/10/2023 |

| FATE UQ | Fate Therapeutics Inc | 1.11% | 5/4/2023 |

| PTCT UW | PTC Therapeutics Inc | 1.11% | 5/3/2023 |

| ISEE UW | IVERIC bio Inc | 1.11% | 5/4/2023 |

| RCUS UN | Arcus Biosciences Inc | 1.10% | 5/9/2023 |

| ARDX UQ | Ardelyx Inc | 1.09% | 5/5/2023 |

| MRNA UW | Moderna Inc | 1.08% | 5/4/2023 |

ICE Semiconductor Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| NVDA UW | NVIDIA Corp | 9.04% | 5/24/2023 |

| AVGO UW | Broadcom Inc | 7.99% | 5/26/2023 |

| TXN UW | Texas Instruments Inc | 7.92% | 4/26/2023 |

| QCOM UW | QUALCOMM Inc | 5.78% | 5/3/2023 |

| INTC UW | Intel Corp | 4.78% | 4/28/2023 |

| LRCX UW | Lam Research Corp | 4.01% | 4/19/2023 |

| ON UW | ON Semiconductor Corp | 3.90% | 5/2/2023 |

| MU UW | Micron Technology Inc | 3.90% | 6/30/2023 |

| MCHP UW | Microchip Technology Inc | 3.84% | 5/9/2023 |

| KLAC UW | KLA Corp | 3.84% | 4/28/2023 |

Dow Jones U.S. Select Home Construction Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| DHI UN | DR Horton Inc | 15.03% | 4/20/2023 |

| LEN UN | Lennar Corp | 13.11% | 6/21/2023 |

| NVR UN | NVR Inc | 8.31% | 4/26/2023 |

| PHM UN | PulteGroup Inc | 6.50% | 4/25/2023 |

| SHW UN | Sherwin-Williams Co/The | 4.43% | 4/26/2023 |

| HD UN | Home Depot Inc/The | 4.39% | 5/16/2023 |

| LOW UN | Lowe's Cos Inc | 4.32% | 5/23/2023 |

| BLD UN | TopBuild Corp | 3.23% | 5/5/2023 |

| TOL UN | Toll Brothers Inc | 3.06% | 5/24/2023 |

| BLDR UN | Builders FirstSource Inc | 2.28% | 5/10/2023 |

S&P Mid Cap 400® Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| AXON UW | Axon Enterprise Inc | 0.70% | 5/10/2023 |

| RS UN | Reliance Steel & Aluminum Co | 0.70% | 4/27/2023 |

| LSCC UW | Lattice Semiconductor Corp | 0.61% | 5/3/2023 |

| HUBB UN | Hubbell Inc | 0.61% | 4/26/2023 |

| BLDR UN | Builders FirstSource Inc | 0.60% | 5/10/2023 |

| GGG UN | Graco Inc | 0.57% | 4/27/2023 |

| DECK UN | Deckers Outdoor Corp | 0.56% | 5/19/2023 |

| CSL UN | Carlisle Cos Inc | 0.55% | 4/28/2023 |

| ACM UN | AECOM | 0.55% | 5/9/2023 |

| JBL UN | Jabil Inc | 0.55% | 6/16/2023 |

Russell 2000® Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| CROX UW | Crocs Inc | 0.34% | 5/5/2023 |

| IRDM UW | Iridium Communications Inc | 0.34% | 4/20/2023 |

| SWAV UW | Shockwave Medical Inc | 0.34% | 5/8/2023 |

| EME UN | EMCOR Group Inc | 0.33% | 4/28/2023 |

| TXRH UW | Texas Roadhouse Inc | 0.32% | 5/5/2023 |

| SAIA UW | Saia Inc | 0.31% | 5/2/2023 |

| INSP UN | Inspire Medical Systems Inc | 0.30% | 5/3/2023 |

| RBC UN | RBC Bearings Inc | 0.29% | 5/26/2023 |

| KNSL UN | Kinsale Capital Group Inc | 0.28% | 4/28/2023 |

| APLS UW | Apellis Pharmaceuticals Inc | 0.27% | 5/4/2023 |

Technology Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| MSFT UW | Microsoft Corp | 23.74% | 4/26/2023 |

| NVDA UW | NVIDIA Corp | 4.86% | 5/24/2023 |

| AVGO UW | Broadcom Inc | 3.53% | 5/26/2023 |

| CSCO UW | Cisco Systems Inc | 2.83% | 5/17/2023 |

| CRM UN | Salesforce Inc | 2.64% | 5/31/2023 |

| TXN UW | Texas Instruments Inc | 2.24% | 4/26/2023 |

| AMD UW | Advanced Micro Devices Inc | 2.08% | 5/3/2023 |

| QCOM UW | QUALCOMM Inc | 1.89% | 5/3/2023 |

| ORCL UN | Oracle Corp | 1.88% | 6/13/2023 |

| INTC UW | Intel Corp | 1.79% | 4/28/2023 |

Energy Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| XOM UN | Exxon Mobil Corp | 23.20% | 4/28/2023 |

| CVX UN | Chevron Corp | 19.69% | 4/28/2023 |

| MPC UN | Marathon Petroleum Corp | 4.63% | 5/2/2023 |

| EOG UN | EOG Resources Inc | 4.56% | 5/4/2023 |

| SLB UN | Schlumberger NV | 4.28% | 4/21/2023 |

| VLO UN | Valero Energy Corp | 4.04% | 4/27/2023 |

| PXD UN | Pioneer Natural Resources Co | 3.67% | 5/4/2023 |

| PSX UN | Phillips 66 | 3.53% | 5/3/2023 |

| OXY UN | Occidental Petroleum Corp | 3.45% | 5/10/2023 |

| HES UN | Hess Corp | 2.80% | 4/27/2023 |

Utilities Select Sector Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| NEE UN | NextEra Energy Inc | 15.52% | 4/21/2023 |

| SO UN | Southern Co/The | 7.69% | 4/28/2023 |

| DUK UN | Duke Energy Corp | 7.61% | 5/9/2023 |

| SRE UN | Sempra Energy | 4.82% | 5/5/2023 |

| D UN | Dominion Energy Inc | 4.74% | 5/5/2023 |

| EXC UW | Exelon Corp | 4.23% | 5/9/2023 |

| XEL UW | Xcel Energy Inc | 3.75% | 4/28/2023 |

| ED UN | Consolidated Edison Inc | 3.45% | 5/5/2023 |

| PEG UN | Public Service Enterprise Group Inc | 3.16% | 5/3/2023 |

| WEC UN | WEC Energy Group Inc | 3.05% | 5/1/2023 |

S&P Transportation Select Industry FMC Capped Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| UPS UN | United Parcel Service Inc | 19.81% | 4/25/2023 |

| UNP UN | Union Pacific Corp | 17.26% | 4/20/2023 |

| UBER UN | Uber Technologies Inc | 8.86% | 5/4/2023 |

| FDX UN | FedEx Corp | 5.06% | 6/20/2023 |

| CSX UW | CSX Corp | 4.59% | 4/20/2023 |

| NSC UN | Norfolk Southern Corp | 4.55% | 4/27/2023 |

| ODFL UW | Old Dominion Freight Line Inc | 4.48% | 4/26/2023 |

| DAL UN | Delta Air Lines Inc | 4.02% | 4/13/2023 |

| LUV UN | Southwest Airlines Co | 3.47% | 4/27/2023 |

| EXPD UW | Expeditors International of Washington Inc | 3.13% | 5/2/2023 |

S&P Retail Select Industry Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| GME UN | GameStop Corp | 1.63% | 6/1/2023 |

| EVGO UW | EVgo Inc | 1.57% | 5/11/2023 |

| CVNA UN | Carvana Co | 1.55% | 4/20/2023 |

| AMZN UW | Amazon.com Inc | 1.42% | 4/28/2023 |

| SIG UN | Signet Jewelers Ltd | 1.36% | 6/9/2023 |

| WMT UN | Walmart Inc | 1.36% | 5/18/2023 |

| ASO UW | Academy Sports & Outdoors Inc | 1.35% | 6/7/2023 |

| VSCO UN | Victoria's Secret & Co | 1.34% | 5/31/2023 |

| GO UW | Grocery Outlet Holding Corp | 1.34% | 5/10/2023 |

| OLLI UQ | Ollie's Bargain Outlet Holdings Inc | 1.33% | 6/8/2023 |

S&P Oil & Gas Exploration & Production Select Industry Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| EQT UN | EQT Corp | 2.42% | 4/27/2023 |

| OXY UN | Occidental Petroleum Corp | 2.41% | 5/10/2023 |

| MPC UN | Marathon Petroleum Corp | 2.40% | 5/2/2023 |

| VLO UN | Valero Energy Corp | 2.40% | 4/27/2023 |

| CNX UN | CNX Resources Corp | 2.38% | 4/28/2023 |

| PXD UN | Pioneer Natural Resources Co | 2.36% | 5/4/2023 |

| HES UN | Hess Corp | 2.36% | 4/27/2023 |

| CVX UN | Chevron Corp | 2.35% | 4/28/2023 |

| EOG UN | EOG Resources Inc | 2.35% | 5/4/2023 |

| XOM UN | Exxon Mobil Corp | 2.35% | 4/28/2023 |

S&P Regional Banks Select Industry Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| NYCB UN | New York Community Bancorp Inc | 4.04% | 4/27/2023 |

| RF UN | Regions Financial Corp | 3.01% | 4/21/2023 |

| MTB UN | M&T Bank Corp | 3.00% | 4/17/2023 |

| FHN UN | First Horizon Corp | 2.93% | 4/18/2023 |

| CFG UN | Citizens Financial Group Inc | 2.92% | 4/19/2023 |

| TFC UN | Truist Financial Corp | 2.87% | 4/20/2023 |

| HBAN UW | Huntington Bancshares Inc/OH | 2.76% | 4/20/2023 |

| EWBC UW | East West Bancorp Inc | 2.64% | 4/21/2023 |

| ZION UW | Zions Bancorp NA | 2.43% | 4/19/2023 |

| WAL UN | Western Alliance Bancorp | 2.36% | 4/21/2023 |

Dow Jones U.S. Select Aerospace & Defense Index

| Ticker | Name | Weight in the Index | Expected Earnings Release |

| RTX UN | Raytheon Technologies Corp | 20.61% | 4/26/2023 |

| BA UN | Boeing Co/The | 17.27% | 4/27/2023 |

| LMT UN | Lockheed Martin Corp | 7.86% | 4/19/2023 |

| GD UN | General Dynamics Corp | 4.54% | 4/27/2023 |

| NOC UN | Northrop Grumman Corp | 4.49% | 4/27/2023 |

| TDG UN | TransDigm Group Inc | 4.37% | 5/10/2023 |

| HWM UN | Howmet Aerospace Inc | 4.32% | 5/3/2023 |

| LHX UN | L3Harris Technologies Inc | 4.25% | 4/28/2023 |

| AXON UW | Axon Enterprise Inc | 4.17% | 5/10/2023 |

| TXT UN | Textron Inc | 4.10% | 4/27/2023 |

Index Descriptions

- S&P 500® Index (SPXT) - Standard & Poor’s® selects the stocks comprising the S&P 500® Index (SPXT) on the basis of market capitalization, financial viability of the company and the public float, liquidity and price of a company’s shares outstanding. The Index is a float-adjusted, market capitalization-weighted index.

- Financial Select Sector Index (IXMTR) - Provided by S&P Dow Jones Indices and includes securities of companies from the following industries: Banks; Thrifts & Mortgage Finance; Diversified Financial Services; Consumer Finance; Capital Markets; Insurance; and Mortgage Real Estate Investment Trusts (REITs).

- Health Care Select Sector Index (IXVTR) - Provided by Standard & Poor’s and includes domestic companies from the healthcare sector, which includes the following industries: pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and health care technology.

- Industrials Select Sector Index (IXITR) - Provided by S&P Dow Jones Indices and includes domestic companies from the industrials sector which includes the following industries: aerospace and defense; industrial conglomerates; marine; transportation infrastructure; machinery; road and rail; air freight and logistics; commercial services and supplies; professional services; electrical equipment; construction and engineering; trading companies and distributors; airlines; and building products.

- Real Estate Select Sector Index (IXRETR) - Provided by S&P Dow Jones Indices (the “Index Provider”) and includes securities of companies from the following industries: real estate management and development and real estate investment trusts (“REITs”), excluding mortgage REITs.

- Dow Jones Internet Composite Index (DJINETT) - Provided by S&P Dow Jones Indices and includes companies that generate at least 50% of their annual sales/revenue from the internet as determined by the Index Provider. Additionally, each stock must have a minimum of three months’ trading history and a three month average market capitalization of at least $100 million. The Index consists of 40 stocks from two different sectors, internet commerce and internet services

- S&P Biotechnology Select Industry Index (SPSIBITR) - Provided by S&P Dow Jones Indices LLC and includes domestic companies from the biotechnology industry. The Index is a modified equal – weighted index that is designed to measure the performance of the biotechnology sub-industry based on the Global Industry Classification Standards (GICS).

- ICE Semiconductor Index (ICESEMIT) - A rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of the thirty largest U.S. listed semiconductor companies.

- Dow Jones U.S. Select Home Construction Index (DJSHMBT) - Measures U.S companies in the home construction sector that provide a wide range of products and services related to homebuilding, including home construction and producers, sellers and suppliers of building materials, furnishings and fixtures and also home improvement retailers. The Index may include large-, mid- or small-capitalization companies.

- S&P Mid Cap 400® Index (SPTRMDCP) - Measures the performance of 400 mid-sized companies in the United States. The Index is a free-float adjusted market capitalization-weighted index composed of liquid common stocks.

- Russell 2000® Index (RU20INTR) - Measures the performance of approximately 2,000 small-capitalization companies in the Russell 3000® Index, based on a combination of their market capitalization.

- Technology Select Sector Index (IXTTR) - Provided by S&P Dow Jones Indices and includes domestic companies from the technology sector which includes the following industries: computers and peripherals; software; diversified telecommunications services; communications equipment; semiconductors and semi-conductor equipment; internet software and services; IT services; electronic equipment, instruments and components; wireless telecommunication services; and office electronics.

- Energy Select Sector Index (IXETR) - Provided by S&P Dow Jones Indices and includes domestic companies from the energy sector which includes the following industries: oil, gas and consumable fuels; and energy equipment and services.

- Utilities Select Sector Index (IXUTR) - Provided by S&P Dow Jones Indices and includes domestic companies from the utilities sector which includes the following industries: electric utilities; multi-utilities; water utilities; independent power producers and energy trades; and gas utilities.

- S&P Transportation Select Industry FMC Capped Index (SPTSCUT) - Provided by S&P Dow Jones Indices and is designed to measure stocks in the S&P Total Market Index that are included in the GICS transportation sub-industry.

- S&P Retail Select Industry Index (SPSIRETR) - A modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the Global Industry Classification Standard (GICS) retail sub-industry.

- S&P Oil & Gas Exploration & Production Select Industry Index (SPSIOPTR) - Provided by Standard & Poor’s Index Provider and includes domestic companies from the oil and gas exploration and production sub industry. The Index is a modified equal weighted index that is designed to measure the performance of a sub industry or group of sub industries determined based on the Global Industry Classification Standards (GICS).

- S&P Regional Banks Select Industry Index (SPSIRBKT) -A modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the Global Industry Classification Standard (GICS) regional banks sub-industry.

- Dow Jones U.S. Select Aerospace & Defense Index (DJSASDT) - Provided by Dow Jones U.S. Index (the “Index Provider”). The Index attempts to measure the performance of the aerospace and defense industry of the U.S. equity market. The Index Provider selects the stocks comprising the Index from the aerospace and defense sector on the basis of the float-adjusted, market capitalization-weight of each constituent. Aerospace companies include manufacturers, assemblers and distributors of aircraft and aircraft parts. Defense companies include producers of components and equipment for the defense industry, such as military aircraft, radar equipment and weapons.