Editor's note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

Financial markets were recently stunned by a banking crisis that sent the likes of Silicon Valley Bank and Signature Bank into receivership. The Federal Deposit Insurance Corporation (FDIC) stepped in to guarantee depositor funds above the previous amount of $250,000, and now, the federal agency is looking to offload these banks to suitors with cleaner balance sheets. Could this disruption in the financial sector lead to a tradable opportunity in precious metal miners?

Can Metal Miners Reclaim Their Luster?

It’s been a volatile start to the year for the precious metal mining sector. The sector began the year on a bullish note before peaking in January. It’s largely been on the retreat since then, but uncertainty surrounding banking could potentially provide the catalyst to turn the tide.

Precious metal mining shares tend to follow the direction of precious metal spot prices. Gold and silver tend to perform well when uncertainty is rising, and confidence in the fiat monetary system is under threat. While this banking crisis may be solved with minimal secondary effects, the initial shock could be sufficient to reignite a bullish appetite for precious metal mining stocks.

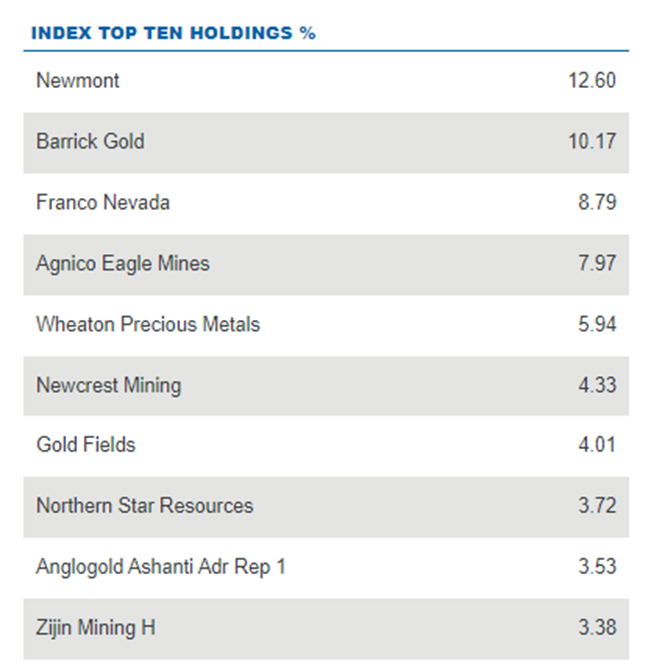

Traders looking for a position in accordance with the bullish outlook in mining shares may consider Direxion’s Daily Gold Miners Index Bull 2X Shares (Ticker: NUGT), which seeks daily investment results, before fees and expenses, of 200%, before fees and expenses, of the daily performance of the NYSE Arca Gold Miners Index.* There is no guarantee the fund will meet its stated investment objective. The fund’s major holdings as of December 31, 2022, include companies like Newmont (Ticker: NEM)(12.60%), Barrick Gold (Ticker: GOLD)(10.17%), and Franco Nevada (Ticker: FNV) (8.79%). Traders may want to keep a close watch on the next round of earnings reports for these companies. Newmont is set to report its next results on April 28, while Barrick Gold and Franco Nevada will report next on May 3. If results come in above estimates, it could kick-start another round of buying in mining stocks. Below is a daily chart of NUGT as of March 16, 2023

Source: TradingView.com

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com/etfs. For standardized performance click here.

What if Metals Can’t Overcome Headwinds?

Precious metals and mining stocks have struggled notably with the Federal Reserve’s hawkish monetary policy. Assuming the Fed doesn’t pivot due to market liquidity issues, and maintains its stance on fighting inflation, bears still have a chance to maintain control in this market.

Traders need to be watchful of the mining sector’s reaction to the Fed’s next rate hike on Wednesday, May 3rd. Fed Chair Powell will give a press conference the same day, and markets are known to move in response to this as well. Looking further ahead, traders will need to keep a close watch on the March Consumer Price Index (CPI) report, which is set to be released on April 12.

Most recently, inflation reports have been coming in above estimates. As long as this remains the case, the Fed may feel pressured to not veer from their hawkish stance, even with the current banking uncertainty.

Those looking to trade the downside in precious metal miners may consider Direxion’s Daily Gold Miners Index Bear 2X Shares (Ticker: DUST), which seeks to track 200% of the inverse (or opposite), before fees and expenses, of the daily performance of the NYSE Arca Gold Miners Index.

Below is a daily chart of DUST as of March 16, 2023.

Source: TradingView.com

Candlestick charts display the high and low (the stick) and the open and close price (the body) of a security for a specific period. If the body is filled, it means the close was lower than the open. If the body is empty, it means the close was higher than the open.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For the most recent month-end performance go to Direxion.com/etfs. For standardized performance click here.

Other Ways to Play the Banking Crisis

Naturally, one way to trade the banking news is to trade the finance sector directly. Direxion offers the Daily Financial Bull 3X Shares (Ticker: FAS) and Daily Financial Bear 3X Shares (Ticker: FAZ), which seek to track 300% or 300% of the inverse (or opposite), respectively, before fees and expenses, of the daily performance of the Financial Select Sector Index*. There’s even a Daily Regional Banks Bull 3X Shares (Ticker: DPST) that seeks to track 300%, before fees and expenses, of the daily performance of the S&P Regional Banks Select Industry Index*.

Traders looking to stick within the metals sector and avoid financials entirely, while seeking a higher-risk play may find an opportunity with Direxion’s Daily Junior Gold Miners Index Bull 2X Shares (Ticker: JNUG) and Daily Junior Gold Miners Index Bear 2X Shares (Ticker: JDST), which seek daily investment results, before fees and expenses, of 200%, or 200% of the inverse (or opposite), respectively, of the performance of the MVIS Global Junior Gold Miners Index.* There is no guarantee these funds will meet their stated investment objectives.

Holdings as of 12/31/2023. Subject to change:

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies that operate globally in both developed and emerging markets, and are involved primarily in mining for gold and, to a lesser extent, in mining for silver. The Index will limit the weight of companies whose revenues are more significantly exposed to silver mining to less than 20% of the Index at each rebalance date. The Index may include small- and mid-capitalization companies and foreign issuers.

The Financial Select Sector Index is provided by S&P Dow Jones Indices and includes securities of companies from the following industries: Banks; Thrifts & Mortgage Finance; Diversified Financial Services; Consumer Finance; Capital Markets; Insurance; and Mortgage Real Estate Investment Trusts.

The S&P Regional Banks Select Industry Index is a modified equal-weighted index that is designed to measure performance of the stocks comprising the S&P Total Market Index that are classified in the Global Industry Classification Standard (GICS) regional banks sub-industry.

The MVIS Global Junior Gold Miners Index tracks the performance of foreign and domestic micro-, small- and mid-capitalization companies that generate, or demonstrate the potential to generate, at least 50% of their revenues from, or have at least 50% of their assets related to, gold mining and/or silver mining, hold real property or have mining projects that have the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.

One cannot directly invest in an index.

The Direxion Daily Junior Gold Miners Index Bull and Bear 2X Shares are not sponsored, endorsed, sold or promoted by Market Vectors Index Solutions GmbH and Market Vectors Index Solutions GmbH makes no representation regarding the advisability of invest in the Direxion Daily Junior Gold Miners Index Bull and Bear 2X Shares. The MVIS Global Junior Gold Miners Index (the “Index”) is the exclusive property of Market Vectors Index Solutions GmbH, which has contracted with Structured Solutions AG to maintain and calculate the Index. Structured Solutions AG uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the Market Vectors Index Solutions GmbH, Structured Solutions AG has no obligations to point out errors in the Index to third parties.

The Financial Select Sector Index and S&P Regional Banks Select Industry Index are each a product of S&P Dow Jones Indices LLC (“SPDJI”), and has been licensed for use by Rafferty. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”); and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Rafferty. Rafferty’s ETFs are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Financials Select Sector Index or S&P Regional Banks Select Industry Index.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

Direxion Shares Risks – An investment in each Fund involves risk, including the possible loss of principal. Each Fund is non-diversified and includes risks associated with the Funds’ concentrating their investments in a particular industry, sector, or geographic region which can result in increased volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of each Fund include Effects of Compounding and Market Volatility Risk, Leverage Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs) Risk, Cash Transaction Risk, Tax Risk, and risks specific to investment in securities of Gold and Silver Mining Companies and the Mining and Metal Industry.

Additional risks of the Direxion Daily Gold Miners Index Bull 2X Shares and Direxion Daily Gold Miners Index Bear 2X Shares, include Emerging Markets Risk, and Canadian Securities Risk. Because the Funds’ Index is concentrated in the gold mining industry and may have significant exposure to assets in the silver mining industry, the Funds will be sensitive to changes in the overall condition of gold- and silver-related companies. Competitive pressures may have a significant effect on the financial condition of gold- and silver-related companies.

Additional risks for theDirexion Daily Junior Gold Miners Index Bull 2X Shares and Direxion Daily Junior Gold Miners Index Bear 2X Shares include Materials Sector Risk, Emerging Markets Risk, Australian Securities Risk, and Canadian Securities Risk. Because the Index is concentrated in the gold mining industry and may have significant exposure to assets in the silver mining industry, the Funds will be sensitive to changes in the overall condition of gold- and silver-related companies. Competitive pressures may have a significant effect on the financial condition of gold- and silver-related companies.

Additional risks include, for the Direxion Daily Gold Miners Index Bull 2X Shares and the Direxion Daily Junior Gold Miners Index Bull 2X Shares, Daily Index Correlation Risk, and for the Direxion Daily Gold Miners Index Bear 2X Shares and Direxion Daily Junior Gold Miners Index Bear 2X Shares, Daily Inverse Index Correlation Risk, and risks related to Shorting.

Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.