Autopilot to Profits? Buckle Up for the EVAV Trading Ride!

Editor's note: Any and all references to time frames longer than one trading day are for purposes of market context only, and not recommendations of any holding time frame. Daily rebalancing ETFs are not meant to be held unmonitored for long periods. If you don't have the resources, time or inclination to constantly monitor and manage your positions, leveraged and inverse ETFs are not for you.

The electric and autonomous vehicle sector has been a prime battleground for traders looking to capture short-term momentum. Shifting consumer demand, policy changes, earnings surprises, and macroeconomic factors continue to create trading opportunities for those who can react swiftly. The Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares (Ticker: EVAV) is designed for traders aiming to capitalize on these fast-moving trends with amplified exposure.

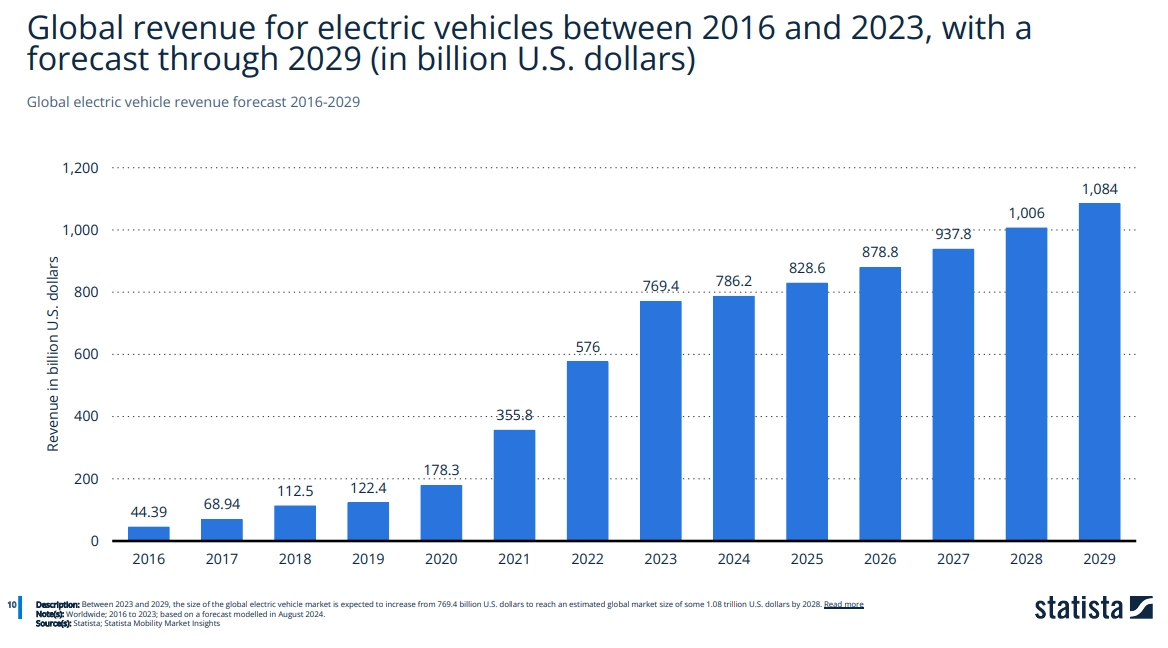

Source: Statista, as of August 2024

The performance data quoted represents past performance. Past performance does not guarantee future results.

Short-Term Catalysts Driving EV and AV Stocks

- Earnings Season Surprises

The upcoming earnings cycle for major electric vehicles (EV) manufacturers, including Tesla, Inc. (Ticker: TSLA), Rivian Automotive, Inc. (Ticker: RIVN), and Lucid Group, Inc. (Ticker: LCID), could spark volatility*. Watch for delivery numbers, profit margins, and guidance updates, as any deviation from expectations could trigger rapid price swings. - Policy Shifts and Subsidy Uncertainty

With President Trump’s recent executive order, “Unleashing American Energy,” eliminating EV subsidies, auto stocks could see knee-jerk reactions as traders weigh the impact. While Stanford research suggests many EV buyers would still make the switch without incentives, short-term traders should monitor automaker responses and consumer sentiment shifts closely. - China’s Influence on the Global Market

China remains the largest EV market, and its production and sales numbers frequently drive sector-wide sentiment. A slowdown in Chinese demand or new government stimulus could move stocks like Nio, Inc. (Ticker: NIO) and XPeng, Inc. (Ticker: XPEV) significantly. - Interest Rates and Consumer Credit Trends

Higher interest rates could pressure auto loan affordability, dampening near-term EV sales. The Federal Reserve’s next rate decision and economic data releases—such as inflation* and job reports—could create rapid shifts in trader sentiment toward EV stocks. - Technological Breakthroughs and Product Announcements

Automakers frequently unveil new battery technology, self-driving advancements, or production targets that can move share prices in a single session. Tesla’s AI Day, Rivian’s production updates, or new partnership announcements with chipmakers like NVIDIA Corporation (Ticker: NVDA) could spark momentum.

Trading the Volatility with Direxion’s EVAV ETF

For traders seeking amplified exposure to these short-term catalysts, the Direxion Daily Electric and Autonomous Vehicles Bull 2X Shares (Ticker: EVAV), which seeks daily investment results, before fees and expenses, of 200% of the performance of the Indxx US Electric and Autonomous Vehicles Index*. This Leveraged ETF allows traders the opportunity to capitalize on the fast-moving nature of EV and AV stocks but should be approached with a disciplined risk strategy, as leverage can magnify both gains and losses.

For those who can actively manage risk, EVAV offers a way to take advantage of rapid shifts in the electric and autonomous vehicle industry. As always, leveraged ETFs are best used for short-term trades and require close monitoring.

*Definitions and Index Descriptions

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying index over periods longer than one day. They are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk and who actively manage their investments.

The Indxx US Electric and Autonomous Vehicles Index is designed to track the performance of electric and autonomous vehicles companies. The Index Provider defines electric and autonomous vehicles companies as those companies that derive at least 50% of their revenues from the following activities (or “sub-themes”): Manufacturers – companies that manufacture and sell electric or autonomous vehicles; Enablers – companies that build infrastructure or create technology for electric or autonomous vehicles, such as charging docks and batteries; and Software and Technology Services – companies that engage in the development of software and technology for electric or autonomous vehicles.

Direxion Shares Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with the Fund’s concentrating its investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts and swaps are subject to market risks that may cause prices to fluctuate over time.

Leverage Risk – The Fund obtains investment exposure in excess of its net assets by utilizing leverage and may lose more money in market conditions that are adverse to its investment objective than a fund that does not utilize leverage. A total loss may occur in a single day even if the Index does not lose all of its value. Leverage will also have the effect of magnifying any differences in the Fund’s correlation with the Index and may increase the volatility of the Fund.

Daily Index Correlation Risk – A number of factors may affect the Fund’s ability to achieve a high degree of correlation with the Index and therefore achieve its daily leveraged investment objective. The Fund’s exposure to the Index is impacted by the Index’s movement. Because of this, it is unlikely that the Fund will be perfectly exposed to the Index at the end of each day. The possibility of the Fund being materially over- or under-exposed to the Index increases on days when the Index is volatile near the close of the trading day.

Electric and Autonomous Vehicles Company Risk — Electric and autonomous vehicles companies typically face intense competition and potentially rapid product obsolescence. Many of these companies are also heavily dependent on intellectual property rights and may be adversely affected by loss or impairment of those rights.

Information Technology Sector Risk — The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation, and competition, both domestically and internationally, including competition from competitors with lower production costs.

Industrials Sector Risk — Stock prices of issuers in the industrials sector are affected by supply and demand both for their specific product or service and for industrials sector products in general.

Consumer Discretionary Sector Risk — Companies in the consumer discretionary sector are tied closely to the performance of the overall domestic and international economy, including the functioning of the global supply chain, interest rates, competition and consumer confidence.

Additional risks of the Fund include Effects of Compounding and Market Volatility Risk, Market Risk, Counterparty Risk, Rebalancing Risk, Intra-Day Investment Risk, Other Investment Companies (including ETFs Risk), Cash Transaction Risk, and Passive Investment and Index Performance Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.