As businesses and employees adjust to the post-Covid work world, one thing is clear: working from home is here to stay. Now that the dust has settled, longer-term remote work trends are beginning to emerge. In fact, remote work has been described as “a classic example of an infant industry” that was given a temporary tailwind (Covid-19), but “remains competitive even after the support is removed.”1 The fact that remote work technology has become a sub-industry within itself incentivizes these companies to continue to support remote work and increases competition in the field.

Remote Work is a Win-Win.

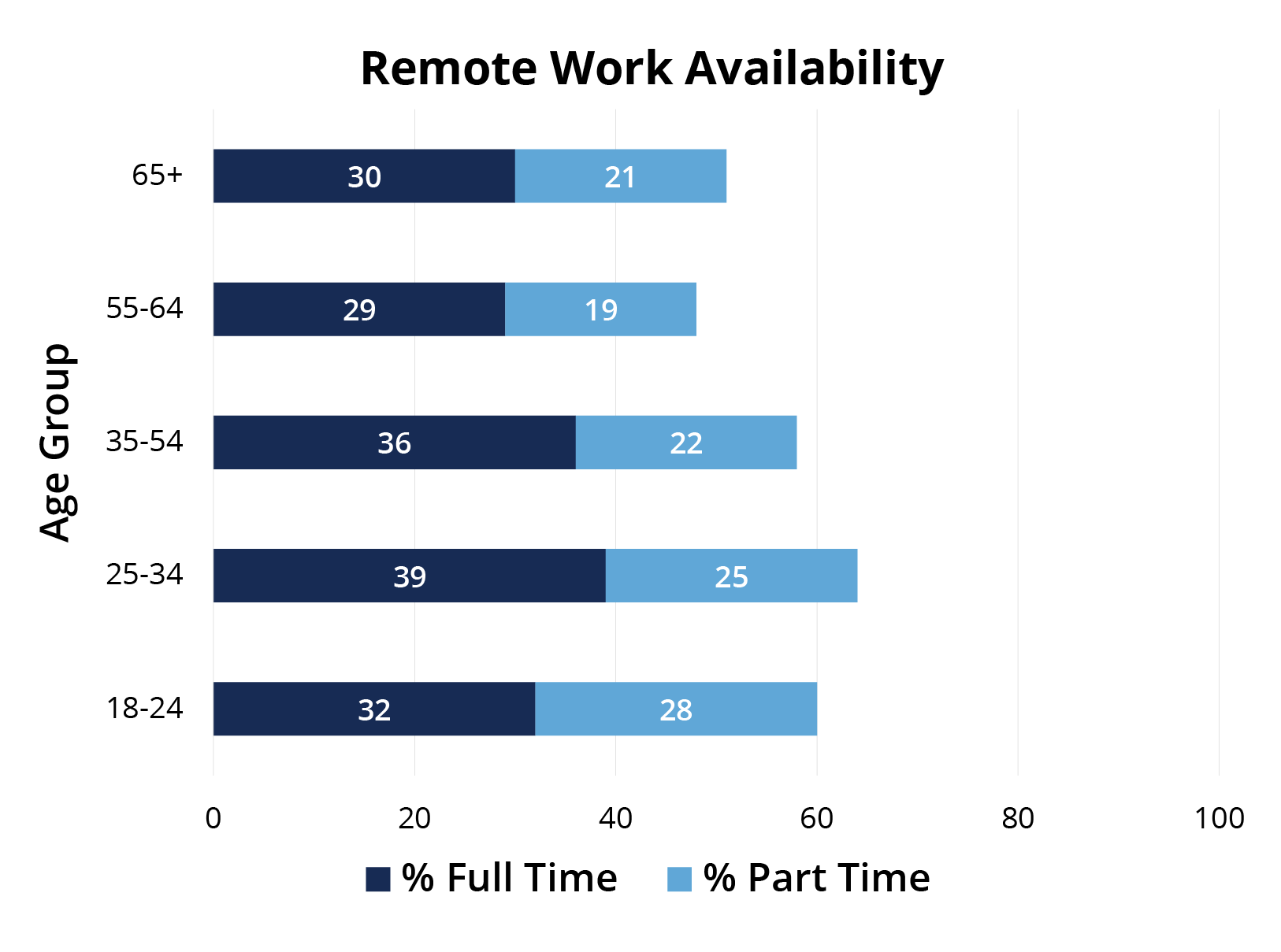

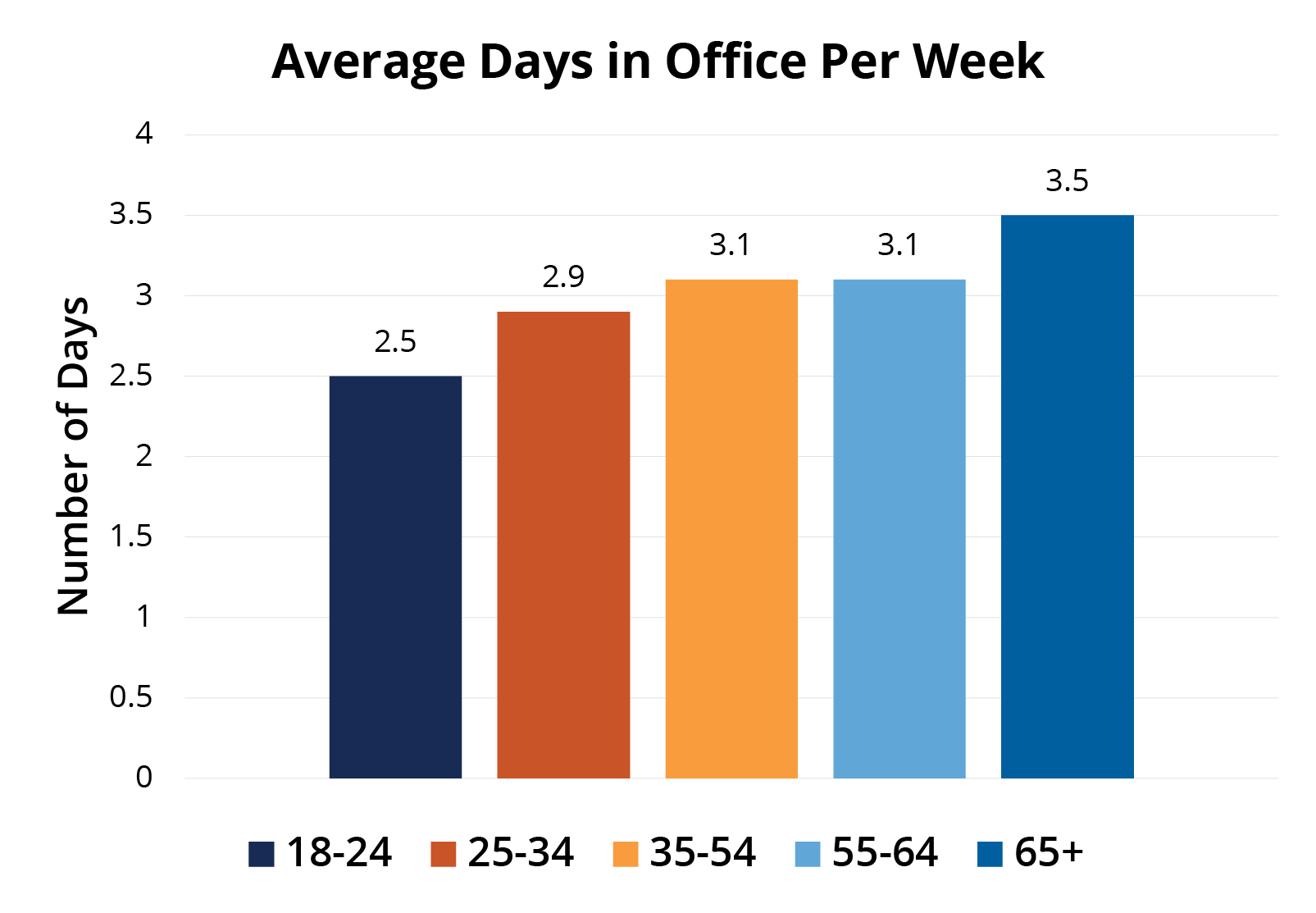

Out of all U.S. workers, nearly 60% of job holders say they can work remotely at least part of the time, which is over 92 million individuals and counting.2 Remote work is not limited to one group or age range. Although younger workers tend to prefer and even demand remote-work options, older generations are not far behind. In fact, those aged 35+ who are offered remote work options tend to stay home more days on average than those aged 18-34.

Source: McKinsey American Opportunity Survey Spring 2022

In terms of the motivation for remote work, 71% of workers say working from home helps with work-life balance, and 56% of workers say it increases their ability to get work done and meet deadlines.3 Thus, on both a personal and productivity level, work from home is beneficial.

Making Remote Work, Work.

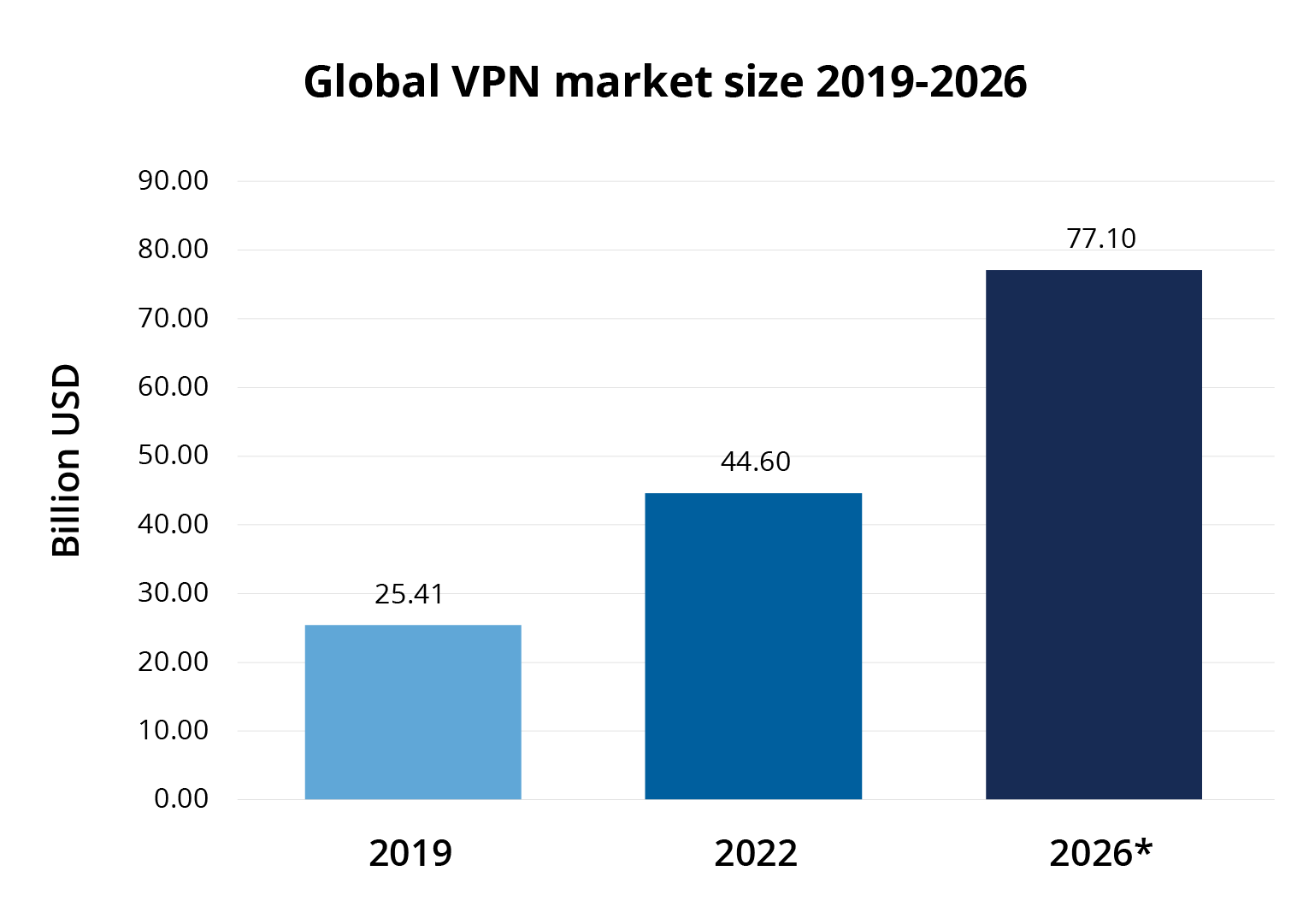

In order for remote work to function effectively and efficiently, certain technologies are required. Collaboration, or the lack thereof, is a concern for employees and employers alike when it comes to remote work. Video conferencing, messaging, and other communication methods are enlisted in order to promote relationship-building remotely. For employers, there are also cybersecurity concerns around remote work. Safe document sharing and cloud technologies need to update seamlessly between the home office and in-person office. Virtual private networks (VPNs) allow employees to securely access their company’s intranet while working from home. The size of the VPN market nearly doubled between 2019 and 2022 as remote work skyrocketed, and is expected to continue to grow.

Source: PR Newswire, Allied Market Research, January 2023

As the work from home model evolves and becomes more permanent, companies that provide these technologies and services must also keep up and innovate. While much of the debate and discussion surrounding work from home revolves around preferences, it is important to remember that in order for this option to even exist, there are a wide array of companies working behind the scenes to provide the technology that enables remote work.

Direxion Work From Home ETF (NYSE: WFH). Consider Investing in the Remote Revolution.

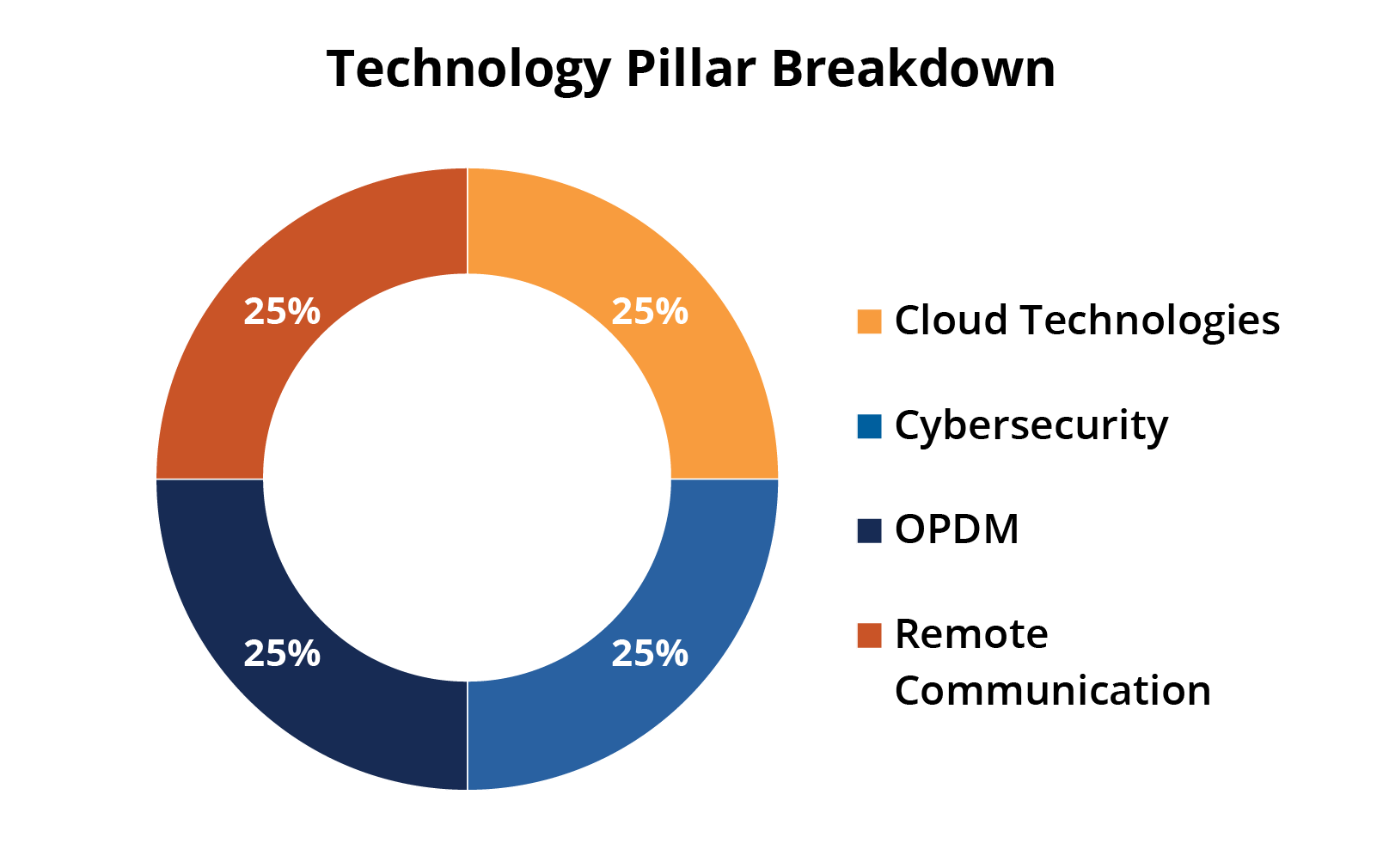

The Direxion Work From Home ETF (NYSE: WFH) seeks investment results, before fees and expenses, that tracks the Solactive Remote Work Index (Ticker: SOLWFHN)*. The index includes 40 stocks that are accelerating greater adoption of remote work. WFH offers equal exposure to companies within these four pillars: Cloud Technologies, Cybersecurity, Online Project and Document Management (OPDM), and Remote Communications.

There is no guarantee that the fund will achieve its investment objective.

Four Pillars of Remote Work

Source: Solactive, as of June 30, 2023.

Index Top 10 Holdings

| Name | Weight (%) | Category |

|---|---|---|

| Meta Platforms Inc. Class A | 3.74 | Remote Communication |

| Adobe Inc. | 3.32 | Online Project and Document Management |

| Broadcom Inc. | 3.20 | Cybersecurity |

| Amazon Corp. | 3.12 | Cloud Technologies |

| Palo Alto Networks | 3.04 | Cybersecurity |

| Microsoft Corp | 3.03 | Cloud Technologies |

| Alphabet Inc. | 2.97 | Cybersecurity |

| Oracle Corp. | 2.96 | Cloud Technologies |

| ServiceNow Inc. | 2.91 | Online Project and Document Management |

| Marvell Technology Inc. | 2.90 | Cybersecurity |

Source: Solactive, as of 7/6/2023. Weightings and top holdings are subject to change.

While the Covid work from home craze may be over, the industry is still young, and Direxion’s WFH ETF offers exposure to the technology companies that are enabling remote work.

1 Opinion | Working From Home and Realizing What Matters - The New York Times (nytimes.com)

2 Americans are embracing flexible work – and they want more of it, McKinsey & Company, June 23, 2022

3 Pew Research Center, February 2023

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

Solactive AG is not a sponsor of, or in any way affiliated with, the Direxion Work From Home ETF.

*The Index is comprised of U.S. listed securities and American Depository Receipts (“ADRs”) of companies that provide products and services in at least one of the following business segments that facilitate the ability of people to work from home: remote communications, cyber security, online project and document management, and cloud computing technologies (“WFH Industries”). The Index consists of approximately 40 companies, namely, the top 10 ranked companies in each of the four WFH Industries. The Index is equal weighted at each semi-annual reconstitution and rebalance date. One cannot directly invest in an index.

Direxion Shares Risks - Investing involves risk including possible loss of principal. There is no guarantee the investment strategy will be successful. The value of stocks of information technology companies and companies that rely heavily on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation and competition, both domestically and internationally, including competition from competitors with lower production costs. ADRs are issued by non-U.S. companies and are subject to various foreign investment risks including but not limited to the risk that the currency in the issuing company’s country will drop relative to the U.S. dollar, that politics or regime changes in the issuing company’s country will undermine exchange rates or destabilize the company and its earnings. Additional risks of the Fund include, but are not limited to, Index Correlation Risk, Index Strategy Risk, Cash Transaction Risk, Tax Risk, and risks associated with the market capitalizations of the securities in which the Fund may invest. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.