December 1981!

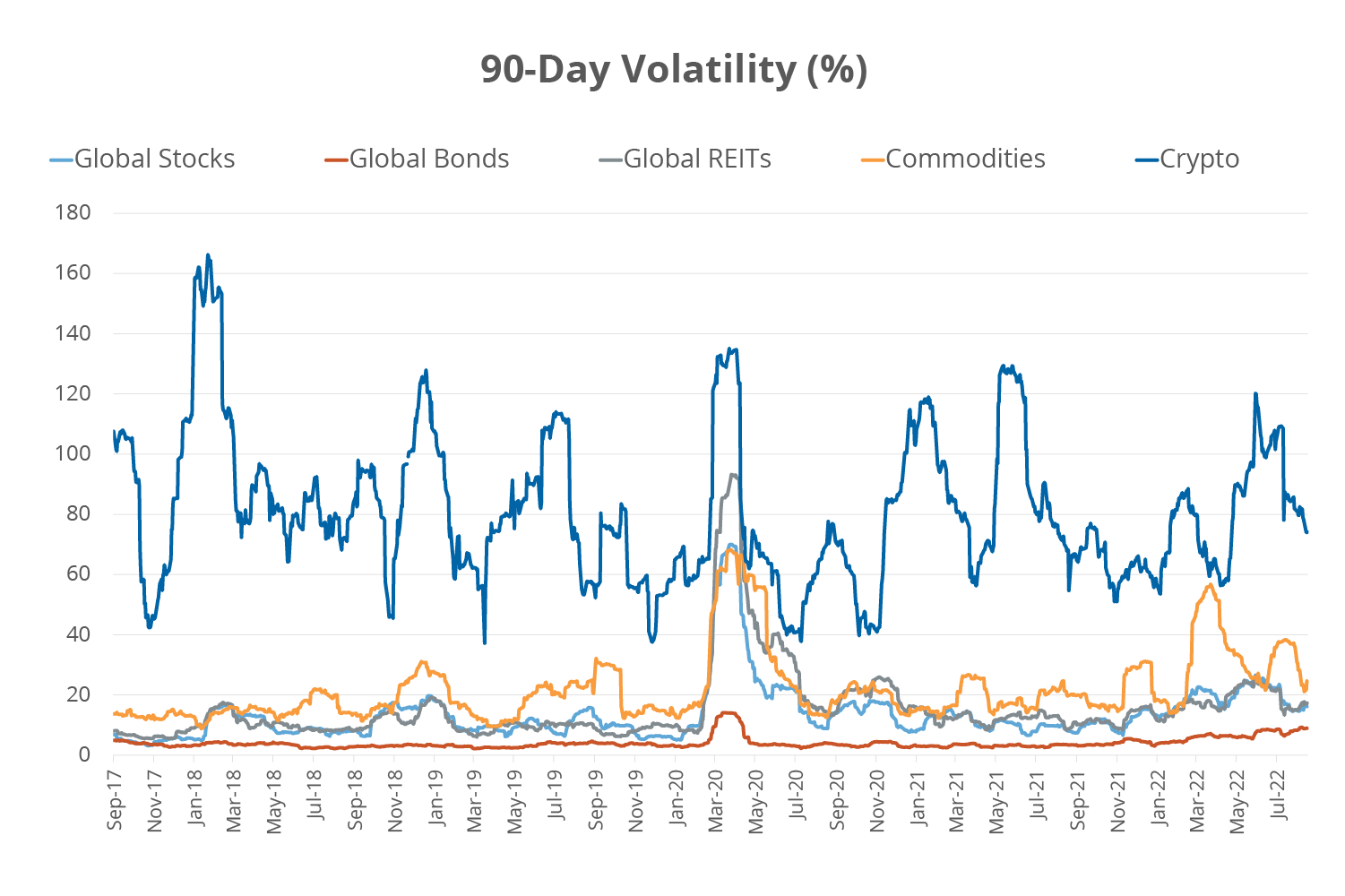

That’s the last time inflation in the US, as measured by the year-over-year change in the Consumer Price Index, was increasing at the rate we see today, which is currently at 8.3%. The persistent level of inflation, coupled with slowing economic growth, has put investors and traders alike on edge. In fact, an entire generation of investors have never navigated an economic backdrop like this one, growing the potential for an increase in volatility across asset classes. Newer, more speculative assets such as cryptocurrencies have exhibited some of the greatest volatility. Cryptocurrencies have seen their volatility spike, even as a greater portion of individuals and institutions gravitate toward the space, which helped push the market capitalization of cryptocurrencies to over $1 trillion at one point earlier in the year.

Crypto’s Volatility is Considerably Higher than other Assets

Source: Bloomberg Finance, L.P., as of August 31, 2022. Past performance is not a guarantee of future results.

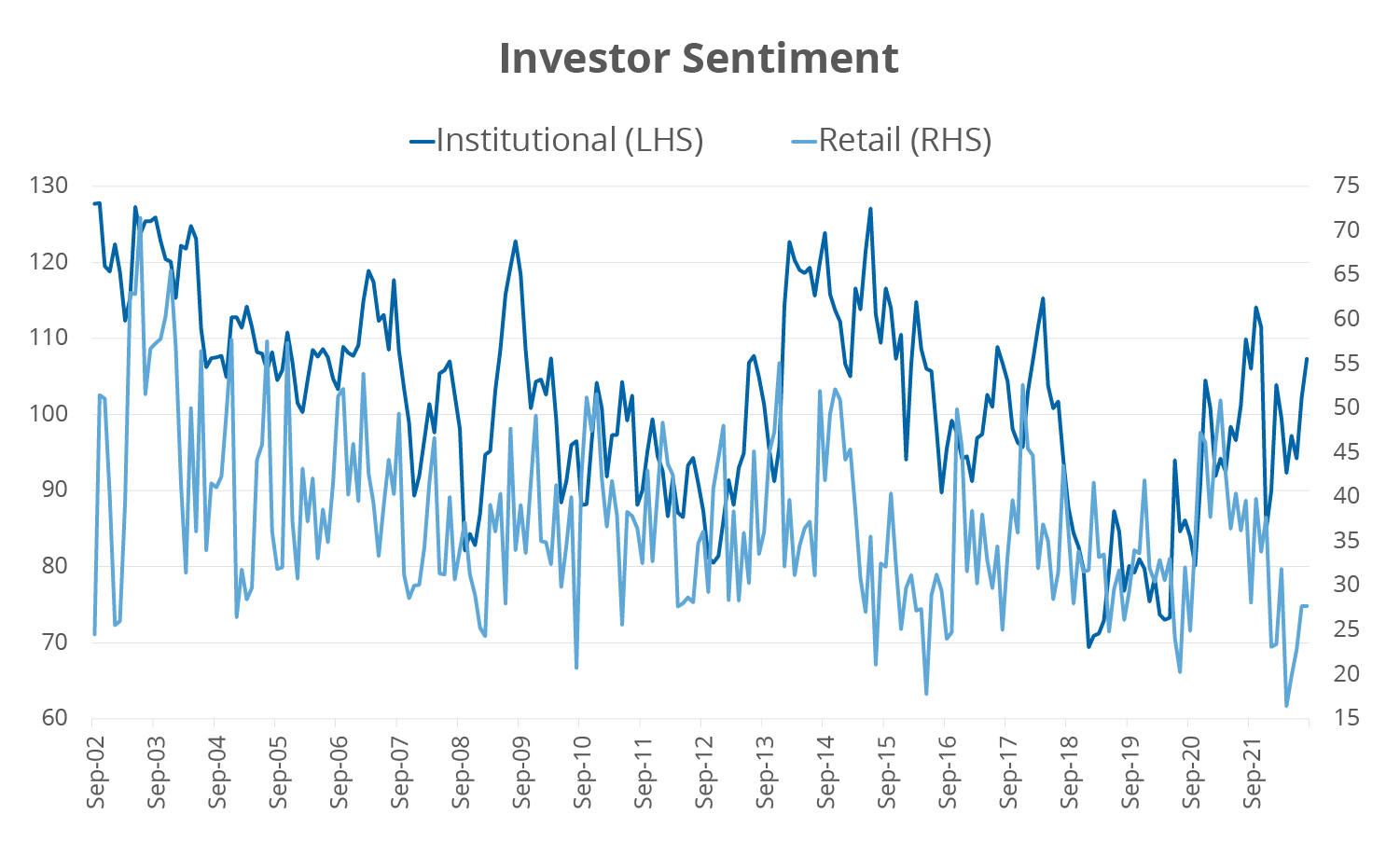

Investor sentiment is another means of assessing the impact of volatility on market behavior. The AAII Sentiment Survey offers insights into the opinions of individual investors by asking their thoughts on where the market is heading in the next six months. The State Street Investor Confidence Index® provides a quantitative measure of global risk tolerance of the world’s sophisticated investors by assessing changes in allocations to risky assets. While these two measures do not compare apples to apples, they both point to a considerable divergence between how retail traders and institutional investors are viewing the market. Retail investors remain bearish on the market, while institutional investors have turned more bullish over the last couple of months.

Sentiment is divided across Institutional and Retail

Source: Bloomberg Finance, L.P., as of August 31, 2022. Institutional represents the State Street Investor Confidence Index and Retail represents the Bullish Readings of the AAII Sentiment Survey. Past performance is not a guarantee of future results. An investment cannot be made direct in an index.

To handle periods of high volatility, one doesn’t need complicated solutions to help them meet their goals. The answer can be as simple as reevaluating one’s time horizon for portfolio construction. One could either lengthen their time horizon to limit the near-term impact of volatility, or reduce it to take advantage of short-term trading opportunities. The main objectives of choosing an investment time frame should be to construct the most resilient portfolio for each investor’s needs, subject to comfort with losses, as well as help mitigate behavioral biases from hampering one’s best intentions.

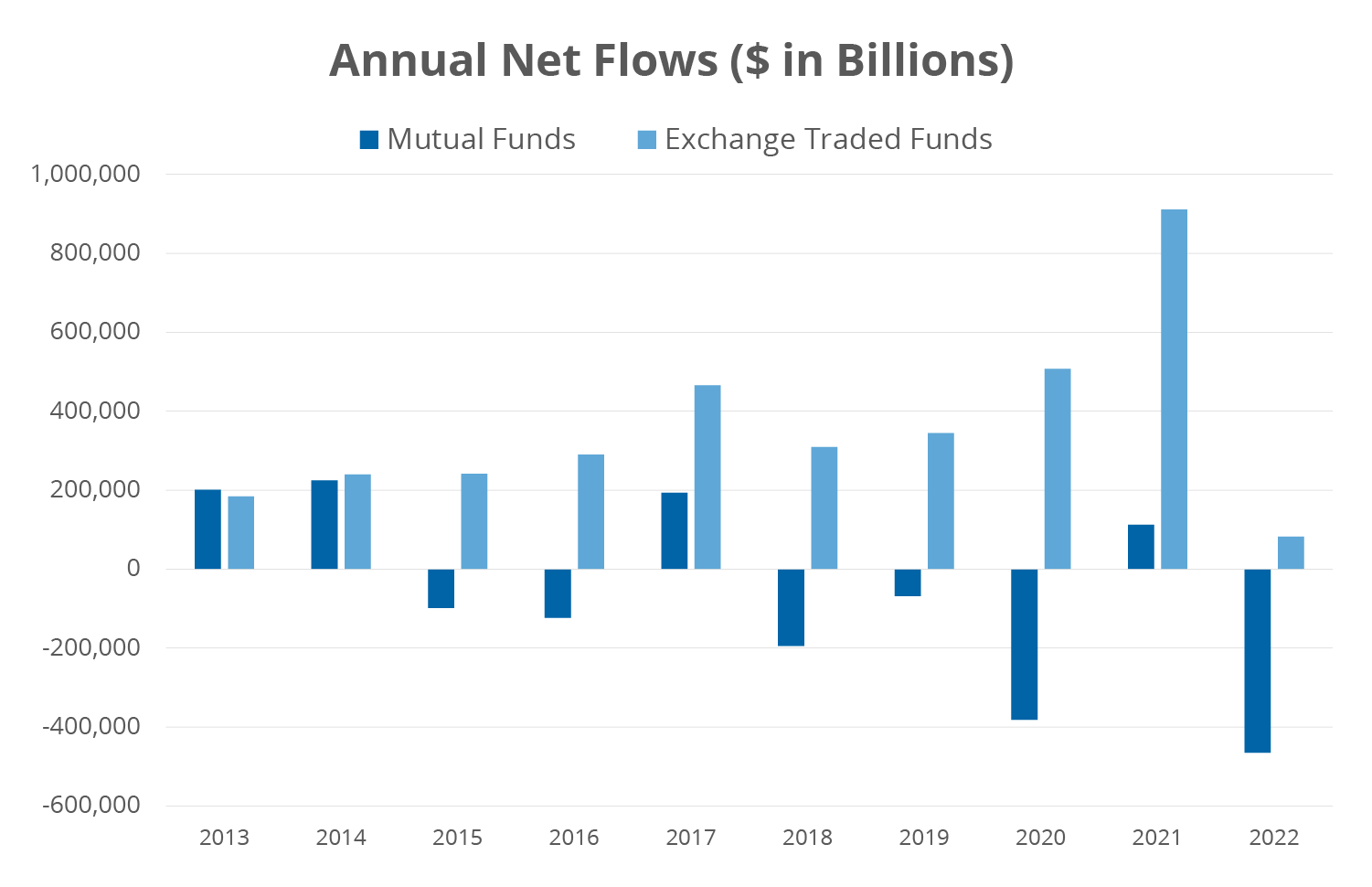

The vehicle of choice for choosing any investment time frame is increasingly ETFs. ETF assets relative to mutual fund assets have increased to 38%, up from 17% in 2013 (Source: Bloomberg). In fact, we may be on the cusp of the next great adoption of ETFs. The first wave of adoption of ETFs happened after the tech bubble burst with Registered Investment Advisors and other intermediaries gravitating toward ETFs, with the second wave occurring after the Global Financial Crisis driven by everyone from retail to institutional investors. The first driver for the next wave of ETF adoption is likely to be long-term investors moving into ETFs, using the opportunity provided by a down market to harvest tax losses from generally higher cost, less tax-efficient mutual funds. The second driver is likely to be traders looking at ETFs as a better tool when compared to meme stocks, cryptocurrencies, and other “assets,” such as trading cards, that were in favor over the last couple of years. These drivers make it clear that the future of navigating tricky market environments lies with ETFs.

ETF Flows are Dwarfing Mutual Funds

Source: Bloomberg Finance, L.P., as of August 31, 2022. Data represented US-listed Exchange Traded Funds and Mutual Funds.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares ETF Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector, which can increase volatility. The leveraged and inverse ETF utilize derivatives, such as futures contracts and swaps which are subject to market risks that may cause their price to fluctuate over time. The leveraged and inverse ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. The leveraged and inverse ETFs may also subject to leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector. The non-leveraged ETFs are subject to certain risks, including imperfect index correlation and market price variance, which may decrease performance. The non-leveraged ETFs may invest in a relatively small number of issuers and, as a result, be subject to greater risk of loss with respect to its portfolio securities. The non-leveraged ETFs may experience greater fluctuation in its net asset value as compared to other investments. The non-leveraged ETFs may be appropriate for investors with a long-term investment time horizon, who primarily seek capital growth, and who are able to tolerate periods of prolonged price declines. Please read each ETF’s prospectus for a more complete description of the investment risks. There is no guarantee that an ETF will achieve its investment objective.