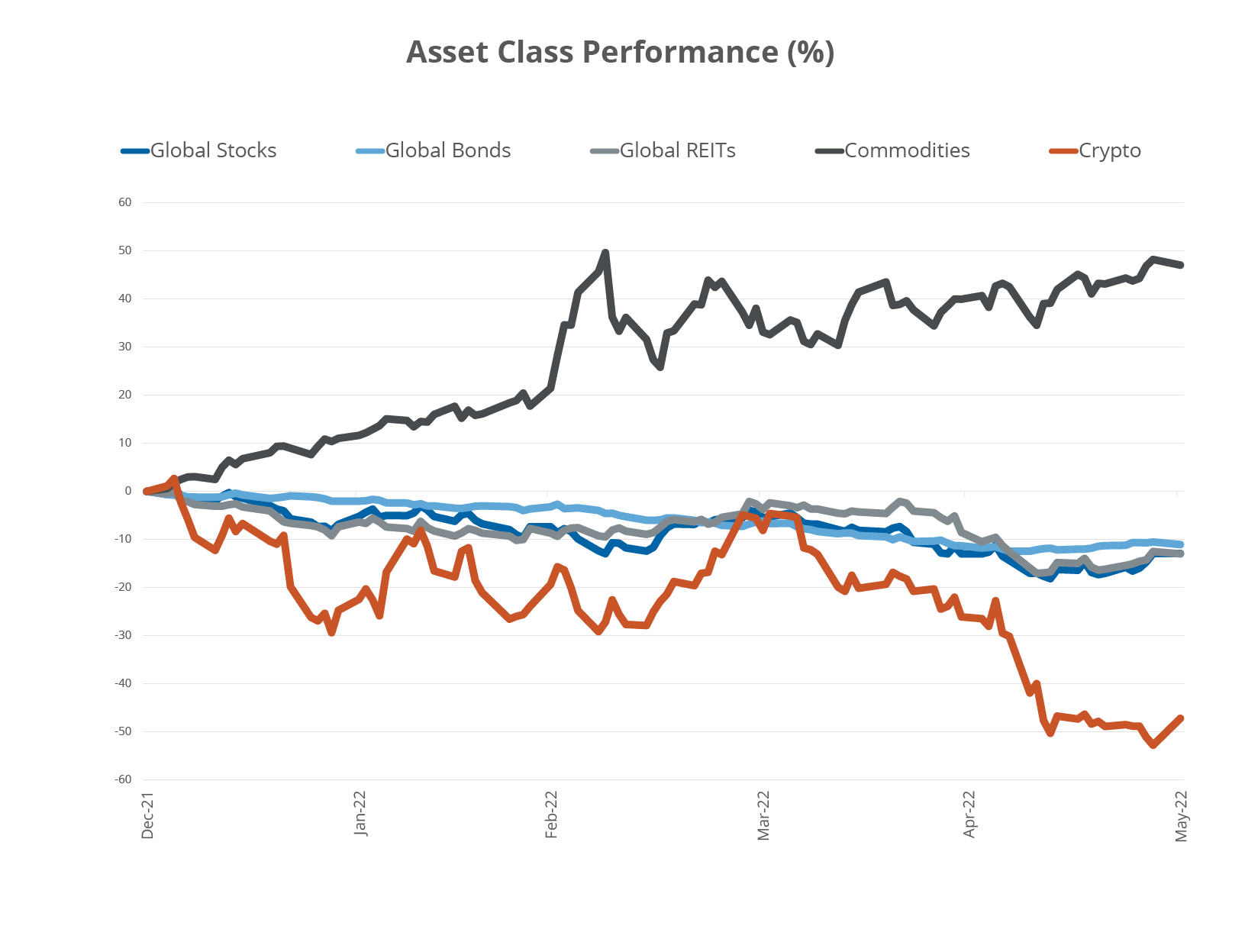

Markets have not been kind to investors in 2022. While the S&P 500 Index never hit a bear market (per closing prices), it does not matter much for investors, as the index has experienced its deepest losses year-to-date since 1970. Through the first five months of the year, nearly every asset class is down, and many are down BIG. Traditional asset allocation strategies have not helped, since both stocks and bonds lost value at the same time. The burgeoning asset class – crypto – has absolutely crashed this year, losing 50% of its value. The only bright spot this year has been commodities, which thanks to years of poor returns are serially under-owned by investors, meaning many portfolios would not have benefited.

Markets are Taking It on the Chin

Source: Bloomberg Finance, L.P., as of May 31, 2022. Global Stocks represents the MSCI ACWI, Global Bonds represents the Bloomberg Global Aggregate Index, Global REITs represents the FTSE EPRA/NAREIT Global Index, Commodities represents the S&P GSCI Index, and Crypto represents the Bloomberg Galaxy Crypto Index. *Index definitions below. Past performance is not indicative of future results. You cannot invest directly in an index.

Looking ahead, inflationary pressures will likely weigh on corporate profits as the cost companies pay for goods and labor rise. So while valuations have declined to more reasonable levels, earnings growth may not deliver, as negative revisions are rising thanks to lingering supply chain issues and increasing inventories.

Additionally, macroeconomic headwinds remain thanks to central banks needing to put the brakes on inflation and remove the accommodative policies in place for years. In the US, the Federal Reserve plans to raise rates 100 bps over the next eight weeks. Quantitative tightening kicks off on June 15, which will further drain liquidity from the financial system.

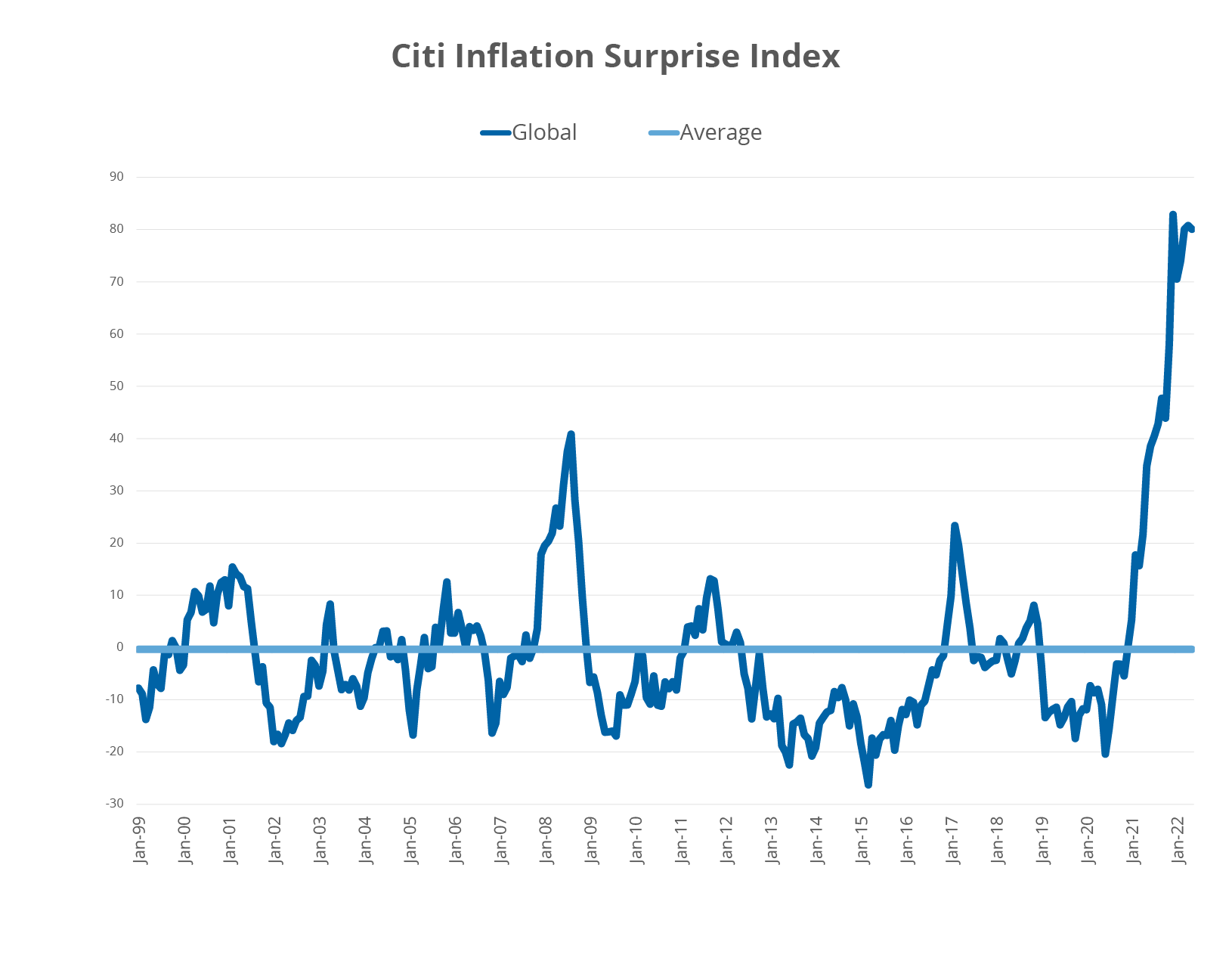

Economists continue to underestimate inflation as numbers come in above their estimates. The Citi Inflation Surprise Index for the globe shows upside surprises to inflation are off the charts meaning economist forecasts are way off target. At the same time, forecasts for economic growth are surprising to the downside, meaning growth is not as strong as projected. These results are highlighting why some are calling for the emergence of stagflation.

Inflation Keeps Surprising to the Upside

Source: Bloomberg Finance, L.P., as of May 31, 2022.

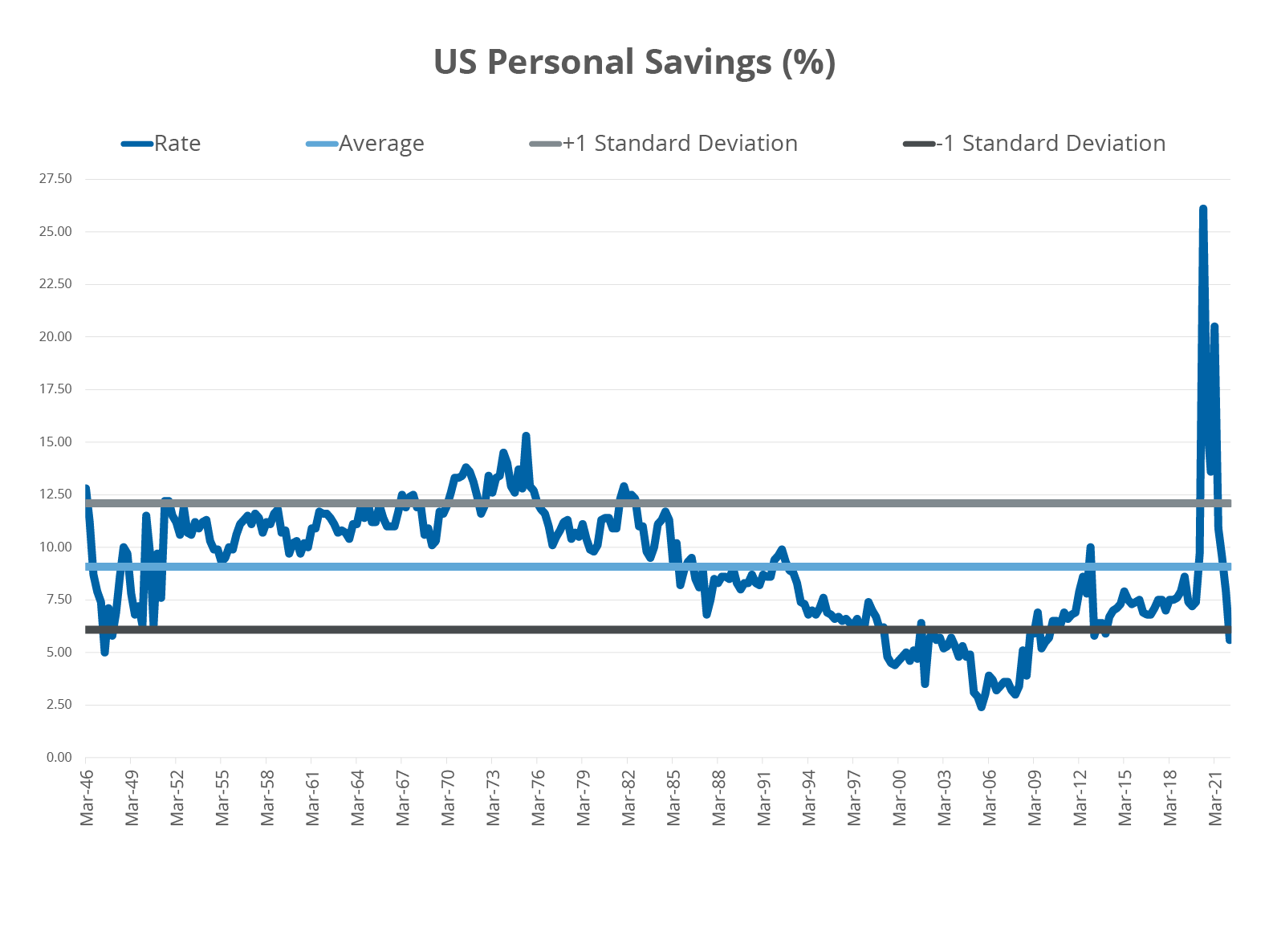

However, recession is not necessarily around the next corner. While certain consumer-facing companies are highlighting inventory buildups and rising costs, job growth remains robust and wages are up. However, inflation has the potential to dampen the consumption of even high income earners who must pay more for essentials, as evidenced by the extreme drop in the personal savings rate. The US Personal Savings Rate has collapsed to well below its historical average. At the end of the day, the ability to avoid a recession in the US is in the hands of the Fed, as they need to reduce the rate and change of price increases, but not slam the brakes on the economy.

The Personal Savings Rate have Plummeted with Rising Prices

Source: Bloomberg Finance, L.P., as of March 31, 2022. Personal saving as a percentage of disposable personal income (DPI), frequently referred to as "the personal saving rate," is calculated as the ratio of personal saving to DPI. Personal saving is equal to personal income less personal outlays and personal taxes.

All of these conflicting data points paint a mixed picture, but one that is clearly tilted toward the downside. For long-term, it is likely best to stay the course in their asset allocations, but ensure that they have exposure to assets that may be best suited for an environment of higher inflation and slower growth.

Real assets, such as commodities can help serve that purpose. Commodities can act as a particularly good diversifier within a broader portfolio due to their historically low correlation to other asset classes. They may also be used as a potential inflation hedge.

For the more tactically oriented investor Direxion offers the Direxion Breakfast Commodity Strategy ETF (BRKY). BRKY is designed to take advantage of rising food prices and generate returns outside of stocks and bonds. It is the first ETF to offer this combination of commodities, and we believe the persistent inflationary environment has created significant tailwinds for the fund. BRKY can be used as a way to express a bullish view on commodity prices.

For a longer-term allocation to a broader basket of commodities, we offer the Direxion Auspice Broad Commodity Strategy ETF (COM). COM allows investors to take advantage of rising commodity prices, in addition to mitigate risk by going flat (cash) when individual commodities are experiencing downward trends. It seeks to potentially provide commodity investment returns with lower risk characteristics than long-only commodity strategies.

Both funds offer opportunities to navigate these mean markets.

*Definitions

MSCI ACWI: Designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

Bloomberg Global Aggregate Index: Represents a close estimation of the performance that can be achieved by hedging the currency exposure of its parent index, the Bloomberg Global Aggregate Bond Index, a broad-based fixed-income index used by investors, to USD.

FTSE EPRA/NAREIT Global Index: The FTSE EPRA/Nareit Global Real Estate Index is a free-float adjusted, market capitalization-weighted index designed to track the performance of listed real estate companies in both developed and emerging countries worldwide. Constituents of the Index are screened on liquidity, size and revenue.

S&P GSCI Index: Serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. It is a tradable index that is readily available to market participants of the Chicago Mercantile Exchange.

Bloomberg Galaxy Crypto Index: Bloomberg Galaxy Crypto Index is designed to measure the performance of the largest cryptocurrencies traded in USD.

Citi Inflation Surprise: Measures the degree to which economic data is either beating or missing expectations.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-301-9214 or visit our website at direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares ETF Risks – An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include Index Correlation Risk, Index Strategy Risk, Derivatives Risk, Commodity-Linked Derivatives Risk, Futures Strategy Risk, Breakfast Commodities Risk, Agriculture Investment Risk, Market Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators’ and/or investors’ demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments.

Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.

Leveraged and inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments.