Everyone loves analogies, as they can help make sense of complicated subjects. They can also be fun. At some point, nearly every parent needs to tell their child to take a break when they’re eating to see if they’re full. Some are starting to say the same about the Federal Reserve. In order to fend off 40-year highs in inflation, the Fed’s been raising rates aggressively this year, just as a hungry eater may not know when to stop. The 3% increase in 2022 shows just how hungry the Fed is to raise rates. Currently, the market expects rates to hit 4.5% next year, an indication that more hikes are likely. In other words, they may not be interested in pausing to see if they are full until their proverbial plates are cleared.

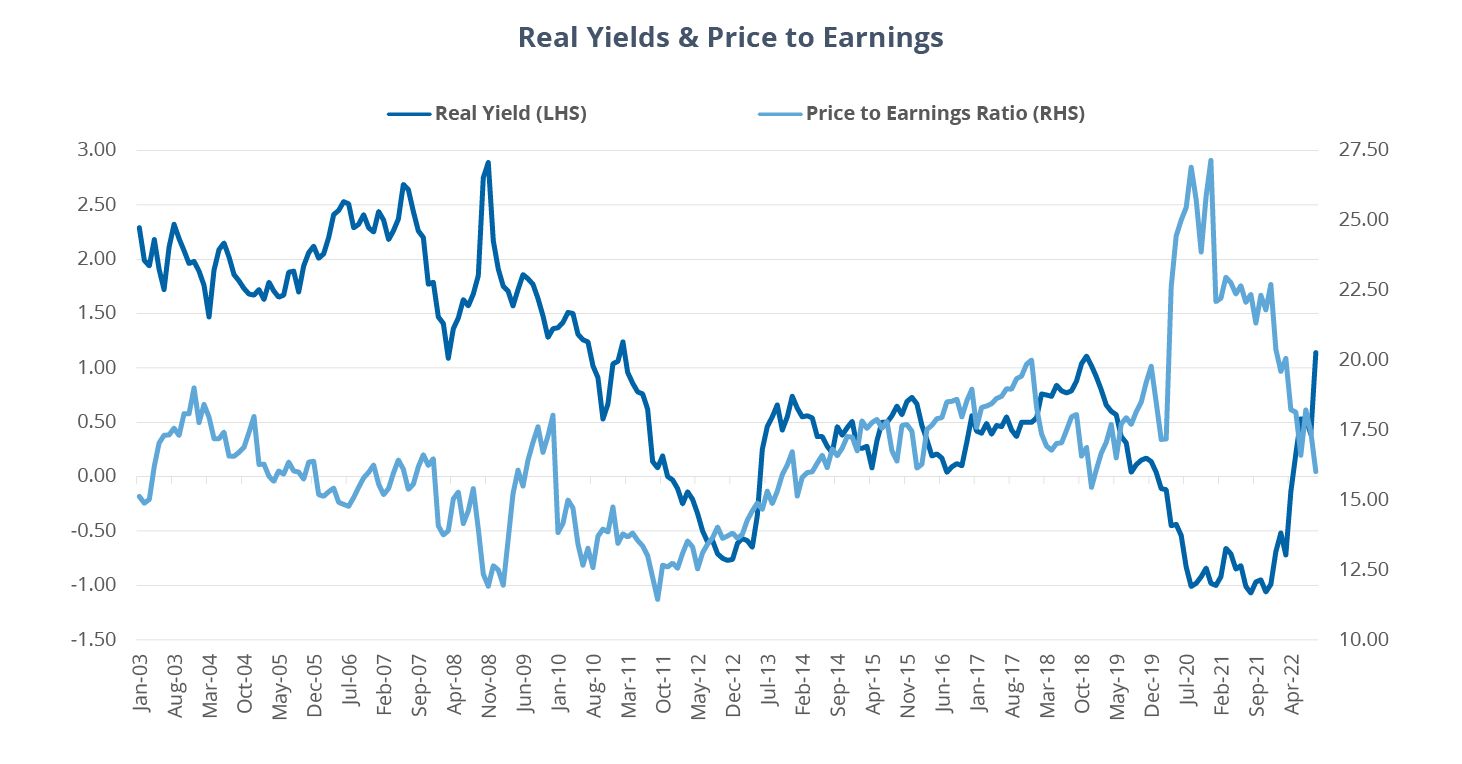

The Fed’s hiking cycle has seen real yields, or the yield (income) an investor would earn from interest after taking into account inflation, increase sharply. Real yields have moved back into positive territory where they historically tend to be. Since income potential after inflation (even with low price pressures) was so muted, investors went out on the risk spectrum for returns. Rising yields make bonds themselves generally more attractive relative to stocks, reducing their appeal on a relative basis. Increasing interest rates tend to dampen economic growth and hinder corporate profits, which impacts how investors value future profit potential. The price-to-earnings ratio has declined to 16x from over 21x a year ago, but is still nowhere the 12 handle last seen in 2012.

Rising Real Yields Are Weighing on Stocks

Source: Bloomberg Finance, L.P., as of September 30, 2022. Real Yield represents the yield of the US Treasury Inflation Protected Securities (TIPS) adjusted to constant maturities and the Price to Earnings Ratio represents the 12-Month Forward Price to Earnings multiple of S&P 500 Index.

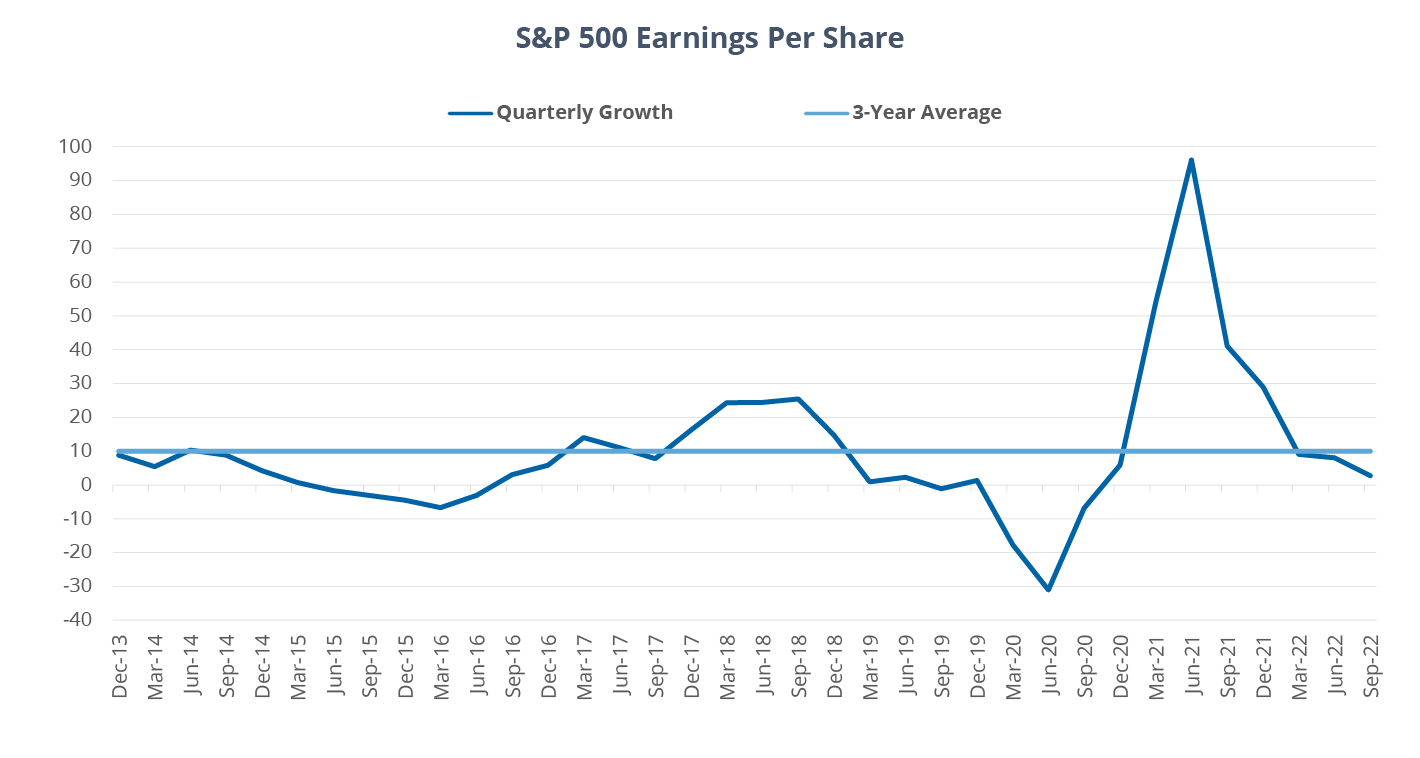

In the third quarter, earnings per share growth for the S&P 500 is expected to come in under 3%, which is the fifth straight quarter of decelerating earnings. This is also significantly lower than the 3-year average of 9.97% and even the median of 5.82%, which reduces the impact of the extremely weak earnings in March and June 2020 and the subsequent recovery in 2021. According to Bloomberg Intelligence, consensus expected earnings to be 9% a few months ago, showing weakening of expectations as the reality of a new operating environment sets in for analysts. Margins are also expected to continue declining as they have been all year, highlighting how certain companies are struggling to adapt to price increases for goods and services.

Quarterly Earnings Are Declining

Source: Bloomberg Intelligence, as of September 30, 2022. Data for September 2022 is forecasted.

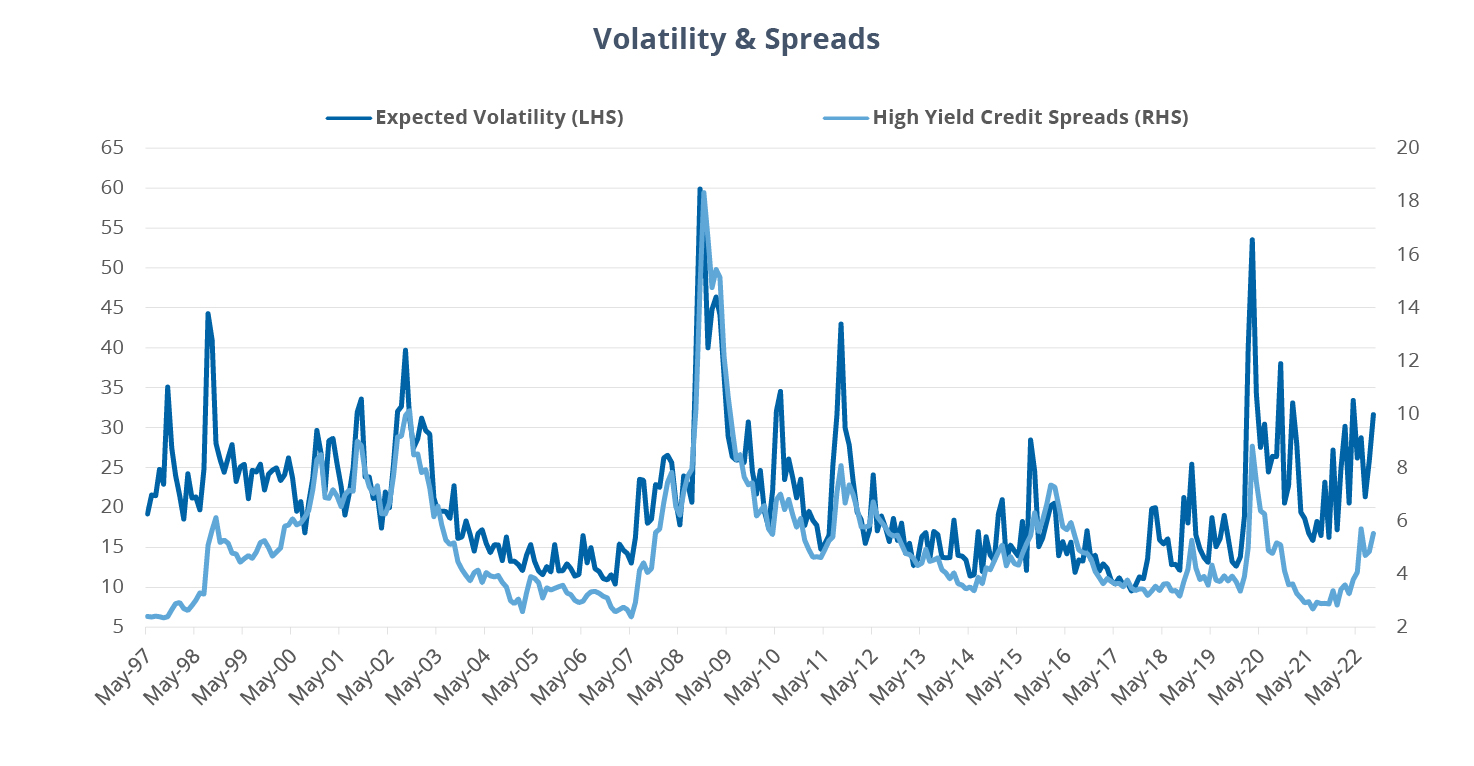

The Fed will likely continue tightening until cracks begin to emerge in the corporate debt market. For the time being, credit spreads, which can be considered a measure of risk, remain relatively tight. However, they’re moving in the wrong direction, ending September at over 5.5% after starting the year at 2.8%. It’s been said credit takes the stairs down and the elevator up, meaning when investors believe there are problems with corporate debt, they widen quickly. Interestingly, the relationship with credit spreads and expected volatility of stocks has decreased. These measures are far from perfectly correlated at any point in time, but their correlation over the last 25 years is 0.71 and has slipped to 0.54 as of the end of September.

Credit Spreads Are Only Starting to Widen

Source: Bloomberg Finance, L.P., as of September 30, 2022. Expected Volatility represents the VIX Index and High Yield Credit Spreads represents the Option-Adjusted Spread of the Bloomberg US Corporate High Yield Bond Index.

Stock market bulls have been pushing the pausing narrative because it gives the Fed an opportunity for them to see the impact of their hiking cycle to date. This thought process may be credible, but instead of missing the days of zero interest-rate policy (ZIRP)* and quantitative easing (QE)*, both long-term investors and tactical traders have an opportunity to embrace today’s market environment as it seems likely, barring an unforeseen event, the Fed will remain on its aggressive tightening cycle. As a result, volatility will likely remain elevated even as traders turn their attention to earnings season, which starts in earnest this week.

Long-term investors may consider ignoring much of this volatility by remaining defensive whether that means stocks in lower volatility sectors or those with attractive dividends. Of course, they may also shift to cash or ultra-short term bonds since the space now actually offers income. For tactical traders who have the ability to monitor their positions frequently, Direxion offers a large suite of Daily Leveraged and Inverse ETFs across a variety of sectors, themes, and even single stocks.

* Definitions

- Zero interest-rate policy (ZIRP): when a central bank sets its target short-term interest rate at or close to 0%. The goal is to spur economic activity by encourage low-cost borrowing and greater access to cheap credit by firms and individuals.

- Quantitative easing (QE): a monetary policy action whereby a central bank purchases government bonds or other financial assets in order to inject monetary reserves into the economy to stimulate economic activity.

An investor should carefully consider a Fund’s investment objective, risks, charges, and expenses before investing. A Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain a Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. A Fund’s prospectus and summary prospectus should be read carefully before investing.

Direxion Shares ETF Risks - An investment in the ETFs involves risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from an ETF’s investments in a particular industry or sector, which can increase volatility. The leveraged and inverse ETF utilize derivatives, such as futures contracts and swaps which are subject to market risks that may cause their price to fluctuate over time. The leveraged and inverse ETFs do not attempt to, and should not be expected to, provide returns which are a multiple of the return of their respective index for periods other than a single day. The leveraged and inverse ETFs may also subject to leverage, correlation, daily compounding, market volatility and risks specific to an industry or sector. The non-leveraged ETFs are subject to certain risks, including imperfect index correlation and market price variance, which may decrease performance. The non-leveraged ETFs may invest in a relatively small number of issuers and, as a result, be subject to greater risk of loss with respect to its portfolio securities. The non-leveraged ETFs may experience greater fluctuation in its net asset value as compared to other investments. The non-leveraged ETFs may be appropriate for investors with a long-term investment time horizon, who primarily seek capital growth, and who are able to tolerate periods of prolonged price declines. Please read each ETF’s prospectus for a more complete description of the investment risks. There is no guarantee that an ETF will achieve its investment objective.