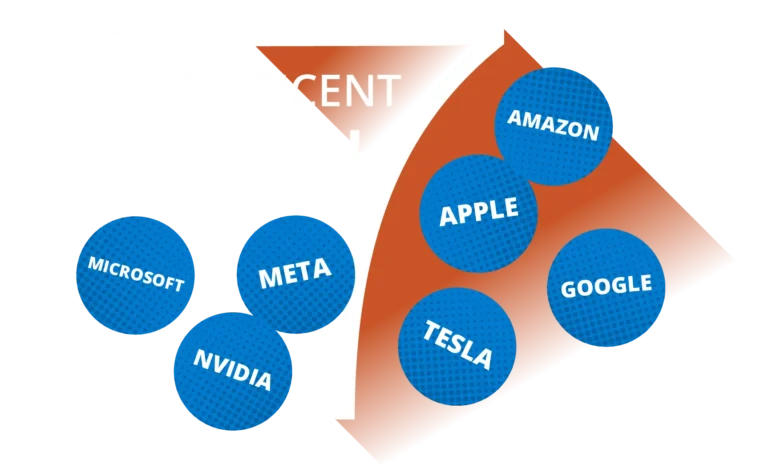

Surgical Trades on the Magnificent 7

Single Stock Daily Leveraged & Inverse ETFs

Risk-hungry traders can now get magnified or inverse exposure to the Magnificent 7 stocks, to seek profit or hedge risk regardless of market direction.

Want to Bet on All Magnificent 7 Stocks at Once? Consider QQQU or QQQD.

With Direxion Daily Magnificent 7 Bull 2X & Bear 1X Shares, traders may respond or anticipate, tactically to headline news, earnings reports, and market sentiment for the Magnificent 7 collectively by trading these funds that provide exposure to a concentrated basket of just these seven stocks.

Frequently Asked Questions About Single Stock ETFs

Single Stock Daily Leveraged & Inverse ETFs are a complex type of ETF that typically seek positive or negative multiples of the daily performance of a single stock rather than of an index. Because these ETFs focus on a single stock, they do not provide diversification.

You may consider them if you are a sophisticated and aggressive investor with:

- The willingness to accept substantial or complete losses in short periods of time

- An understanding of the unique nature and performance characteristics of funds which seek daily investment results

- The time and attention to manage your positions frequently to respond to changing market conditions and fund performance.

These ETFs may not be appropriate if you:

- Cannot tolerate substantial or even complete losses in short periods of time.

- Are unfamiliar with the unique nature and performance characteristics of funds which seek leveraged and inverse investment results

- Are unable to manage your portfolio actively and make changes as market conditions and fund performance dictate.

Trading Single Stock Leveraged & Inverse ETFs involves a high degree of risk.

Unlike traditional ETFs, or even other leveraged and/or inverse ETFs, these leveraged and/or inverse single-stock ETFs track the price of a single stock rather than an index, eliminating the benefits of diversification.

Leveraged and inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying stock’s performance over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments.

If you want to bet on all seven of our single stocks at once, consider QQQU or QQQD.

With our Daily Magnificent 7 Bull 2X & Bear 1X ETFs, traders may respond tactically to headline news, earnings reports, and market sentiment for the Magnificent Seven collectively.

Why Trade Single Stock Daily Leveraged & Inverse ETFs?

Haven’t traded Single Stock Daily Leveraged & Inverse ETFs? Read this article to learn why, when, and how traders use them.