Why Trade Single Stock Daily Leveraged & Inverse ETFs?

Direxion Single Stock Leveraged & Inverse ETFs offer high-stakes tools for traders looking to amplify gains, hedge positions, and speculate on market movements.

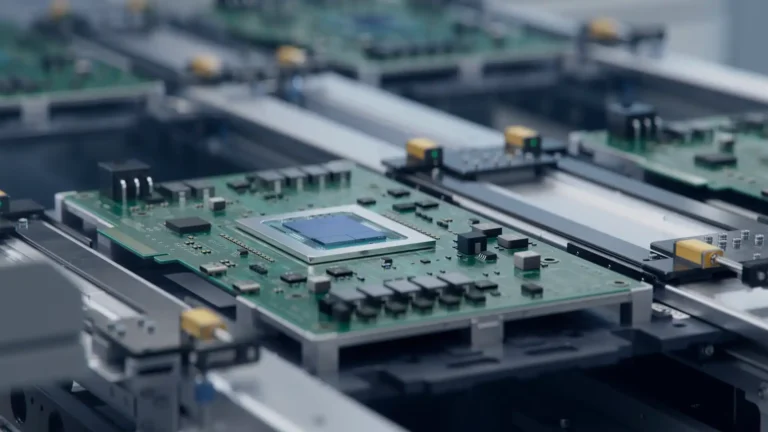

Watch this video to learn about how they work, and why risk-hungry traders might consider trading these funds to seek short-term gains. Visit our Single Stock ETFs listing to see our full suite of options, which covers the full Magnificent 7 line up, including Apple, Tesla, Nvidia, and more.

Other Single Stock Resources & Insights

Investing in the funds involves a high degree of risk. Unlike traditional ETFs, or even other leveraged and/or inverse ETFs, these leveraged and/or inverse single-stock ETFs track the price of a single stock rather than an index, eliminating the benefits of diversification. Leveraged and inverse ETFs pursue daily leveraged investment objectives, which means they are riskier than alternatives which do not use leverage. They seek daily goals and should not be expected to track the underlying stock’s performance over periods longer than one day. They are not suitable for all investors and should be utilized only by investors who understand leverage risk and who actively manage their investments. The Funds will lose money if the underlying stock’s performance is flat, and it is possible that the Bull Fund will lose money even if the underlying stock’s performance increases, and the Bear Fund will lose money even if the underlying stock’s performance decreases, over a period longer than a single day. Investing in the Funds is not equivalent to investing directly in the stock.