The Direxion Auspice Broad Commodity Strategy ETF (COM) ended the quarter slightly positive as the strategy outperformed most of its peers, especially those with a heavier weighting to Energy. Precious Metals led the way higher, while the Energy complex detracted.

The U.S. Dollar pulled back during the quarter largely due to the Fed starting to enact its rate cutting cycle. We will see how aggressive the Fed will be regarding further rate cuts, as they continue to be data dependent. Based on recent inflation* data, it seems inflation will remain sticky and continue to be a thorn in the Fed’s side.

Year-to-date (as of 9/30/2024), the COM’s performance has outshined most of the competition within the Morningstar US Fund Commodities Broad Basket category. Going into the last quarter of the year, COM has been in defensive mode, currently long only three (Gold, Silver, and Sugar) out of the possible 12 commodities. The ability to go to Cash with an individual commodity when it is showing a downward price trend has allowed the strategy to avoid some of the pullbacks to which static long-only commodity indices are prone.

Precious Metals (Gold and Silver) were up strongly for the quarter as the Fed’s shift in rate policy contributed to weakness in the U.S. Dollar, helping to push the two metals higher. Gold continued to build on its momentum from the first half of the year, as it hit new all-time highs during the quarter. Despite risk assets continuing to trend higher during the quarter, the CBOE Market Volatility Index (VIX)* spiked as high as 60. Gold continues to be the preferred flight to safety, especially as rates seemed to have peaked. With heightened geopolitical risks and the U.S. election around the corner, expect Precious Metals to be an area of ongoing opportunity.

Energies experienced their worst quarter over the last year as fears of a widening conflict in the Middle East were more than offset by growing concerns of a global demand slowdown, combined with the chance of OPEC+ unwinding their current supply cuts. We will see if the Energy markets maintain some premium based on the fluid Middle East situation. Quarter-end saw renewed optimism for Oil bulls with the Chinese government’s announcement of its latest fiscal stimulus plans. China is the top oil importer and an important cog to the demand story for Energies. The magnitude of the stimulus may contribute meaningfully to an economic rebound for Energy. Moreover, India’s growth and infrastructure spend remains a significant demand factor. The COM ETF had some exposure to the Energy markets when the quarter started, but due to downward price trends had no exposure as the quarter ended.

The markets with the least amount of opportunity this year, have been the Agriculturals−both Grains and Softs. The Grains are all down double digits for the year, largely because of record harvest levels. Soft Commodities have shown some signs of life, with the COM ETF going long Sugar during the quarter. The recent droughts and fires in Brazil (world’s largest sugar supplier) have raised concerns on potential supply shortages. Weather-related issues in India and Thailand (the number two and three sugar producers worldwide) could also impact global supply. Going into the 4th quarter, COM is long only Sugar within the Agriculturals sector.

To view the Fund's current positions, click here. Positions are subject to risk and change.

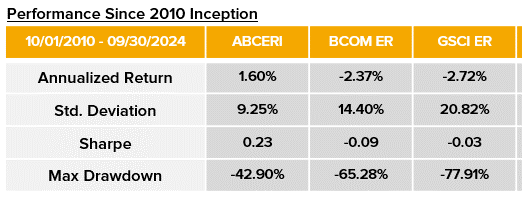

If considering an investment to commodities, one should be aware that traditional static long-only commodity strategies can be volatile* in nature, and not all commodity strategies are created equal. The Direxion Auspice Broad Commodity Strategy ETF (COM) differentiates itself from its peers through a rules-based tactical approach to commodity investing that seeks to provide most of the commodity upside, while seeking to mitigate downside risk. The COM ETF has ranked consistently as a 4 or 5 Morningstar rated fund overall within the Broad Commodity category over its nearly 8-year record. As of 9/30/2024, COM received a 5-star rating overall (out of 100 funds), a 4-star rating for the 3-year period (out of 100 funds), and a 5-star rating for the 5-year period (out of 96 funds). The underlying strategy, Auspice Broad Commodity (ABCERI)*, has been published by NYSE since October 2010 and has outperformed the Bloomberg Commodity Excess Return Index (BCOM ER)* and Goldman Sachs Commodity Index (GSCI ER)* indices with much lower risk characteristics over this timeframe.

Source: NYSE, from 10/1/2010 – 9/30/2024

Please click here for standardized performance of the fund.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns for performance under one year are cumulative, not annualized.

Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Because of ongoing market volatility, fund performance may be subject to substantial short-term changes. For additional information, see the fund’s prospectus.

(1) Annualized Return and past performance does not guarantee future results. Index returns and correlations are historical and are not representative of any Fund performance. Total returns of the Index include reinvested dividends. One cannot invest directly in an index. (2) Standard Deviation is a measure of the dispersion of a set of data from its mean. (3) Maximum Drawdown is the greatest percent decline from a previous high. (4) The Sharpe ratio is a financial metric used to evaluate the risk-adjusted performance of an investment. It measures the difference between the investment's return and the risk-free rate, divided by the standard deviation of its returns.

As we enter the 4th quarter, Commodities will continue to be an area of interest with inflation and the U.S. election being top of mind. Regardless of the market environment, having an allocation to commodities, particularly a tactical strategy that can manage risk when commodity markets inevitably correct, can provide strong diversification. This is increasingly important today with inflation at normal levels and bonds no longer providing the diversification to stocks they did last decade.

*Definitions and Index Descriptions

An investor should carefully consider the Fund’s investment objective, risks, charges, and expenses before investing. The Fund’s prospectus and summary prospectus contain this and other information about the Direxion Shares. To obtain the Fund’s prospectus and summary prospectus call 866-476-7523 or visit our website at www.direxion.com. The Fund’s prospectus and summary prospectus should be read carefully before investing.

The CBOE Volatility Index (VIX) is a real-time market index representing the market’s expectations for volatility over the coming 30 days

The Auspice Broad Commodity Index (ABCERI) is a rules-based long/flat broad commodity index that seeks to capture the majority of the commodity upside returns, while seeking to mitigate downside risk. The Index is made up of a diversified portfolio of 12 commodities futures contracts (Silver, Gold, Copper, Heating Oil, Natural Gas, Gasoline, Crude Oil, Wheat, Soybeans, Corn, Cotton, and Sugar) that based on price trends can individually be Long or Flat (in Cash). One cannot directly invest in an index.

The Goldman Sachs Commodity Index (GSCI) is a composite index of commodity sector returns representing an unleveraged, long-only investment in commodity futures that is broadly diversified across the spectrum of commodities.

The Bloomberg Commodity Excess Return Index (BCOM) is a broadly diversified index that allows investors to track 19 commodity futures through a single, simple measure.

Direxion Shares Risks - An investment in the Fund involves risk, including the possible loss of principal. The Fund is non-diversified and includes risks associated with concentration that results from the Fund’s investments in a particular industry, sector, or geographic region which can result in increased volatility. The Fund’s use of derivatives such as futures contracts and swaps are subject to market risks that may cause their price to fluctuate over time. Risks of the Fund include, but are not limited to, Index Correlation Risk, Derivatives Risk, Commodity-Linked Derivatives Risk, Futures Strategy Risk, Passive Investment and Index Performance Risk, Counterparty Risk, Cash Transaction Risk, Subsidiary Investment Risk, Interest Rate Risk, and Tax Risk. Please see the summary and full prospectuses for a more complete description of these and other risks of the Fund.

Exchange-traded commodity futures contracts generally are volatile and are not suitable for all investors. The value of a commodity-linked derivative investment typically is based upon the price movements of a physical commodity and may be affected by changes in overall market movements, volatility of the index, changes in interest rates, or factors affecting a particular industry or commodity, such as global pandemics, weather and other natural disasters, changes in supply and production, embargoes, tariffs and international economic, political and regulatory developments and changes in speculators' and/or investors' demand. Commodity-linked derivatives also may be subject to credit and interest rate risks that in general affect the value of debt securities. The Fund’s investments in derivatives may pose risks in addition to, and greater than, those associated with directly investing in securities or other investments.

Risks associated with the use of futures contracts are (a) the imperfect correlation between the change in market value of the instruments held by the Fund and the price of the futures contract; (b) possible lack of a liquid secondary market for a futures contract and the resulting inability to close a futures contract when desired; (c) losses caused by unanticipated market movements, which are potentially unlimited; (d) the Index’s inability to predict correctly the direction of securities prices, interest rates, currency exchange rates and other economic factors; (e) the possibility that the counterparty will default in the performance of its obligations; and (f) if the Fund has insufficient cash, it may have to sell securities or financial instruments from its portfolio to meet daily variation margin requirements, which may lead to the Fund selling securities or financial instruments at a time when it may be disadvantageous to do so.