Tesla’s Climb, Rising Inflation, and Corporate Downfalls

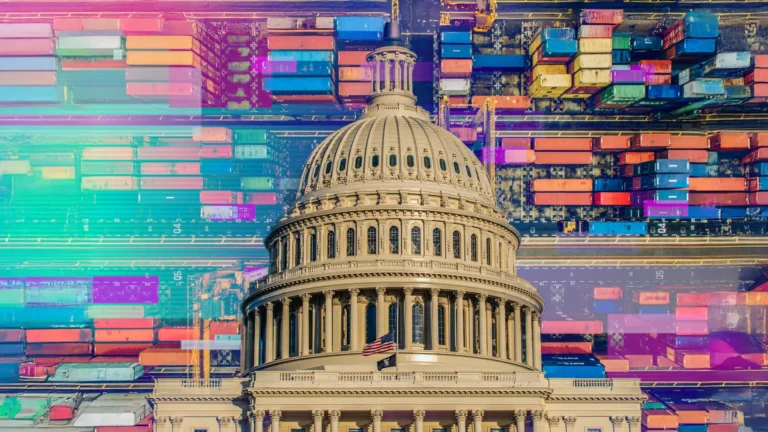

- Another Uptick – U.S. import prices increased 0.3% in October 2024, following a 0.4% decline in September 2024. Similarly, the price index for U.S. exports increased 0.8% in October 2024 after a 0.6% decline in September 2024. Fuel imports led the October 2024 increases, rising 1.5% (source: U.S. Bureau of Labor Statistics).

- Increasing Inflation – The Consumer Price Index noted a 0.2% increase in October 2024, primarily led by a 0.4% rise in the shelter index and a 0.2% increase in the food index. This brings the average increase over the last 12 months to 2.6% (source: U.S. Bureau of Labor Statistics).

- Back in Business – After the November 5th election, Tesla’s stock price jumped 15% from $251.44 to $288.53 per share. By Monday, November 11th, the share price reached $350.00 per share, the highest price since July 2022 (source: Google Finance).

- Debilitating Debt – Franchise Group Inc., the owner of many well-known brands, like Vitamin Shoppe and Pet Supplies Plus, has filed for Chapter 11 bankruptcy, citing $2 billion in debt. This announcement comes after Franchise Group’s CEO, Brian Kahn, stepped down amid a criminal investigation related to securities fraud (source: Yahoo Finance).

- Deploying Dollars – Berkshire Hathaway is putting some of their cash to use, investing in Domino’s Pizza and Pool Corp. Berkshire Hathaway already held 1.28 million shares of Domino’s and 404,000 shares of Pool before the recent investment (source: Reuters).

- Bye Bye Bank – The First National Bank of Lindsay was officially closed by the Office of the Comptroller of the Currency on October 18th, marking the second bank failure in 2024. First Bank & Trust Co. is taking over all deposits (source: FDIC).

- Low Spirits – Spirit Airlines filed for bankruptcy protection on November 18th, 2024, following failed merger attempts, upcoming debt maturities, and consistent financial losses. Existing bondholders have already committed to providing $300 million in debtor-in-possession financing (source: Reuters).

- Fighting Fraud – The shadow chief executive officer of National Realty Investment Advisors, Thomas Nicholas Salzano, has been sentenced to 12 years in prison for his contribution to a $658 million Ponzi scheme involving more than 2,000 investors between February 2018 and January 2022. Salzano diverted investment funds to himself, friends, and family members (source: Internal Revenue Service).

- The Top Dog – Disney becomes the first studio to cross $4 billion in global box office performance, following the releases of Inside Out 2 and Deadpool & Wolverine (source: Disney).

- Turkey Travel – A new study by AAA found that 1.7 million more people will travel for Thanksgiving in 2024 compared to 2023. A majority of this increase comes in the form of car travel, with an estimated 71.7 million people making road trips, a 1.3 million increase from 2023 (source: Reuters).

This newsletter is provided for informational purposes only and does not constitute investment advice or a recommendation regarding any specific product or security. Past performance is not indicative of future results. You cannot invest directly in an index. All references to tax or legal matters are provided for informational purposes only. You should consult your legal or tax professional regarding your specific situation. All investing is subject to risk, including possible loss of principal.

For current fund holdings, please click on the related fund links included above.